Mergers and Acquisitions Services

How our mergers and acquisitions services help identify effective solutions.

NMS Consulting advises corporate and private equity clients on creating value through business acquisition, combination or divestiture, including joint ventures, strategic alliances and other alternative structures. Drawing upon our team’s extensive industry and transactional expertise, we provide unbiased and confidential knowledge to help you realize your goals. NMS supports clients through every stage of the transaction lifecycle.

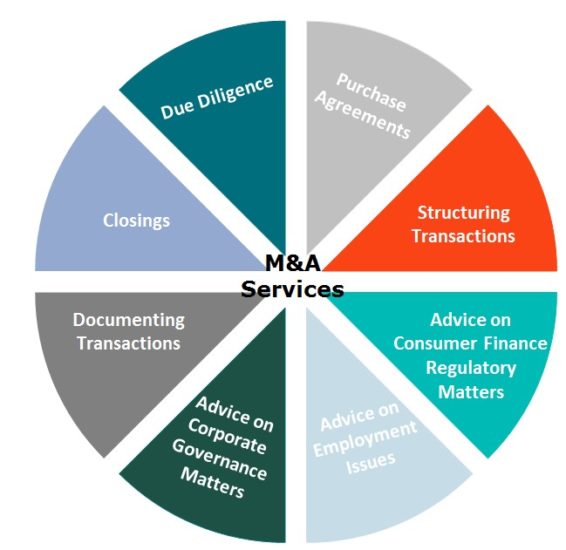

Our mergers and acquisitions services include:

M&A Strategy Development

Our consultants work closely with you to develop a comprehensive M&A strategy that aligns with your business goals. Whether you’re looking to expand your market presence, diversify your portfolio, or optimize your operations, we have the expertise to create a tailored plan for success.

Due Diligence and Risk Assessment

Thorough due diligence is crucial in any M&A transaction. Our team conducts meticulous research and analysis to provide you with a clear understanding of the opportunities and risks associated with potential acquisitions. We help you make informed decisions to safeguard your investment.

Valuation and Financial Analysis

Accurate valuation is essential to determine the fair market value of target companies. Our financial experts employ industry-leading methodologies to assess the financial health of your prospects, ensuring that you negotiate from a position of strength.

Negotiation and Deal Structuring

We excel in negotiation and deal structuring, aiming to secure favorable terms for our clients. Whether you’re buying, selling, or merging, we will represent your interests with precision and dedication, striving to maximize value and minimize risk.

Integration and Post-Merger Support

Successful integration post-transaction is critical to realize the full potential of your M&A endeavors. We provide comprehensive support to ensure a seamless transition, helping you achieve synergy, operational efficiency, and sustained growth.

Why Choose Us

Our consulting firm stands out for several reasons:

- Proven Expertise: Our team comprises seasoned professionals with a strong track record of successful M&A transactions.

- Client-Centric Approach: We prioritize your goals and objectives, tailoring our services to meet your unique needs.

- Global Network: We have a wide-reaching network of industry contacts and partners, enhancing our ability to identify and execute strategic opportunities.

- Confidentiality: We understand the importance of discretion in M&A, and we maintain the highest level of confidentiality throughout the process.