Private Equity Services

Our private equity services guide you along the investment lifecycle with a focus on synergies.

The focus of our private equity services is to provide you and your team with increased deal confidence, while reducing deal risks, and providing insights and expertise to achieve a successful acquisition. With about $3 trillion in dry powder, we understand the importance of efficiency and investment returns. We work alongside your people to provide support throughout the full transaction cycle, including post-merger integration (PMI).

Our asset optimization techniques focus on equipment effectiveness and maintenance reliability, with a focus on improvement driven by asset performance and data. Our consultants are well versed in strategies needed to obtain revenue growth, improve product life cycles, and reduce service costs. We focus on methods to increase customer engagement, accurately assess scalability and quality of technology investments, identify potential ways to maximize usage of technology platforms, and assess digital transformation opportunities and investments that will create value. In addition, our cost optimization methodology leads to improvements in G&A, human capital, and direct costs. Our services include:

- Target identification

- Due Diligence

- Relationship management

- Carve-out planning

- Supply chain/procurement

- Portfolio and asset optimization

- Exit support

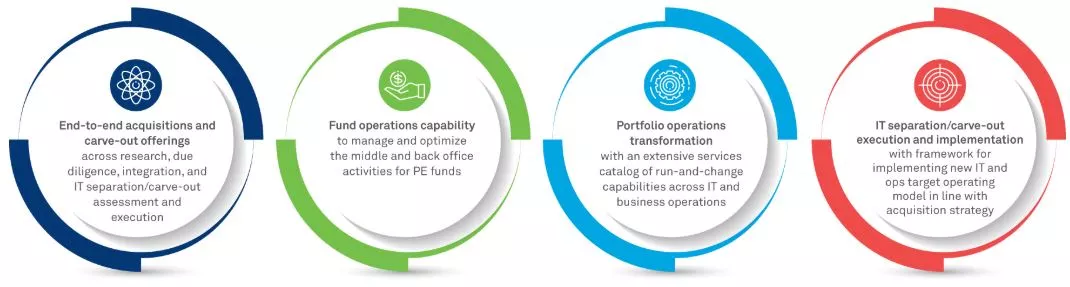

How our private equity services can help.

We draw on decades of private equity consulting expertise, with a global knowledge base and deep industry insight to help you achieve optimal investment returns. With a presence in the U.S., Europe, Asia, and the United Arab Emirates, we pride ourselves on a a solid track record in global deals. Our highly responsive team will be focused on providing quality work in a short period of time. We strive to enhance revenue and margin capabilities by leveraging our strategies that focus on improving sales operations, pricing, margins, and value. Our portfolio assessments are based on thorough analysis of your organization’s operational performance. This approach yields detailed data that guides us in roadmap implementation suitable for your portfolio’s needs and benefit quantification. We focus and adapt the operations due diligence to the initial investment hypotheses and investment thesis of our private equity clients.

Our team’s experience in synergy assessments and sell side due diligence provides you with an accurate look into the portfolio’s performance. We provide effective identification and implementation support needed to obtain optimal value during the selling process. Also, once an acquisition is made, we will assist you in maximizing the revenue and EBITDA potential of the deal.

Private Equity Value Optimization

Global Coordinator

Trevor M. Saliba

Global Head of Private Equity, M&A and Strategy

Private Equity, M&A and Strategy

Beverly Hills

Frank Mizuno

Mergers & Acquisitions

Beverly Hills

Arthur Mansourian

Cybersecurity & Data Privacy, Mergers & Acquisitions

Beverly Hills

Brenda Natarajan

Private Equity

Beverly Hills