SPAC Consulting Services

Our SPAC consulting services are designed to assist you in the going public process from start to finish.

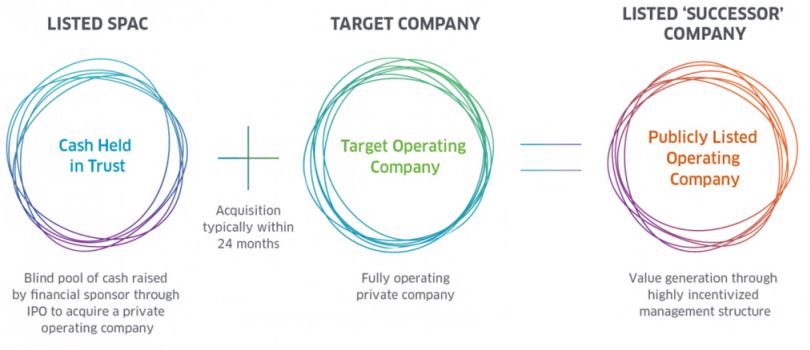

Over the past few years, SPACS (Special Purpose Acquisition Company) have surged in interest as bankers and celebrities have joined in on the method of going public without having to go through the traditional cumbersome process. With $138 B worth of SPAC IPOs globally in 2021 ($83 B in 2020), and with most SPACs taking place in the US, our SPAC consulting services can provide crucial support. SPACs can enable private equity firms and other sponsors to close a transaction resulting in being a publicly traded company with less cost than a traditional IPO, and in a timely and efficient manner.

SPACs are complex due to regulations, and must be completed within short time frames. We offer potential sponsors and companies looking to be acquired by a SPAC our extensive expertise related to transaction due diligence and analysis, reporting and financials preparation, regulatory and filing support, creation of internal controls and corporate governance programs to ensure a streamlined process for a successful transaction closing. We will tackle challenges head on to ensure all transactional risks are accounted for, customizing solutions to help your organization realize its goals, and positioning you for success.

How our SPAC consulting services help.

NMS Consulting advises corporate clients on creating value through SPACs by drawing upon our team’s extensive transactional expertise.

Our SPAC consulting services for target companies who are seeking to be acquired by a SPAC include:

- Preparation for being a public entity (due diligence, financials, tax structuring)

- SPAC Sponsor Group identification

- Structure negotiation

- Internal controls, governance, and review

- Addressing regulatory and compliance requirements

Our SPAC consulting services for SPAC Sponsor Groups include:

Structure

We advise the Sponsor Group on the most suitable legal entity structure and offering terms. We are also able to help the Sponsor Group in developing and refining their corporate strategy, industry sector analysis and corporate message for both the capital markets and targets. In addition, in certain cases, we are able to make introductions to parties who may provide additional sponsor capital investment and join the Sponsor Group.

Management Team

It is important that the SPAC have a strong management team comprised of professionals with the necessary experience in both the target industry/sector and public markets. If needed, NMSC is able to provide members of its own team to serve on the SPAC management team as part of our interim management services, or introduce qualified individual(s) to supplement the overall team. Target companies may also have a need for an interim management service, to better position themselves for an acquisition.

Key Professionals

We are able to introduce and screen the most qualified professionals taking into consideration track record, availability and costs for the sponsor team. This primarily consists of accountants/auditors, lawyers, insurance providers and investment banks/underwriters/placement agents.

Preparation

Sponsor teams are able to benefit from our expertise in regard to the preparation of all requisite marketing materials, financials preparation, regulatory and corporate governance controls working in conjunction with the SPAC auditor and law firm:

- Preparation of the initial SPAC financial statements

- Preparation of pro-forma financials and models

- Management discussions and analysis (MD&A)

- Dilution and capitalization tables for S-1

- Drafting for Form 10Qs and 10Ks

- Drafting of internal control and review

- Preparation of corporate governance program

- Assist in drafting and preparing certain sections of the prospectus (legal cost savings)

- Preparation of all SPAC sponsor’s marketing for the underwriters and the sponsor investors

- Preparation of target landscape analysis

Target Acquisition

NMSC is able to provide comprehensive consulting services to the Sponsor Group for the entire life cycle of the acquisition process.

- Target identification and outreach

- Due Diligence (Financial, Operational, Regulatory and Technical)

- Financial analysis and transaction support to professional service providers

- Valuations

- Preparation of investor presentations, pro-forma financials, combined financials presentation of proposed business combination

- Target identification and outreach

- Due Diligence (Financial, Operational, Regulatory and Technical)

- Financial analysis and transaction support to professional service providers

- Valuations

- Preparation of investor presentations, pro-forma financials, combined financials presentation of proposed business combination

Post-Business Combination

NMSC specializes in providing the following ongoing consulting services to the management team following the completion of the business combination to ensure a seamless transition to ensure success:

- Creation of integration strategy and approach to maximize shareholder value

- Identification of cost savings/synergies

- Organization design for leadership, controls and workforce optimization

- Change management

- Corporate Governance – Board of Directors, Regulatory and Compliance

- Enterprise Resource Planning (ERP)

- Digital Transformation

- Strategy

- Tax Advisory

- Interim Management (Financial, Operational, Digital)

How does a SPAC work?

Global Coordinator

Trevor M. Saliba

Global Head of Private Equity, M&A and Strategy

Private Equity, M&A and Strategy

Beverly Hills

Arthur Mansourian

Cybersecurity & Data Privacy, Mergers & Acquisitions

Beverly Hills

Tonette Santillan

Valuation & Financial Advisory

Beverly Hills