By Aykut Cakir and Trevor Saliba

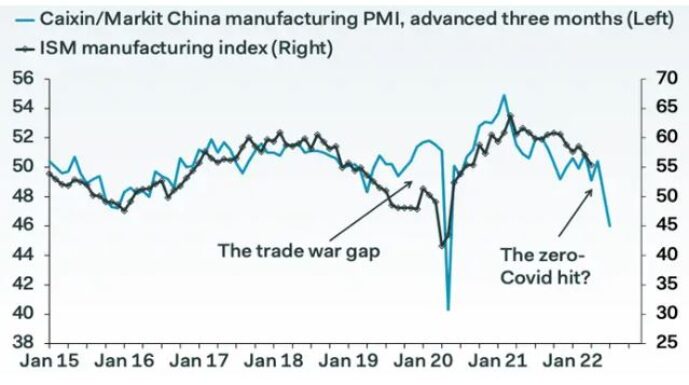

With soaring inflation, rising interest rates, China’s COVID lockdown disrupting manufacturing, and a war creating an energy crisis, many analysts believe we are about to be in a recession. Recessions are defined as two consecutive quarters of negative economic growth, and can be caused by various issues such as a sharp increase in oil prices, financial panics, volatility with economic expectations, or a combination of these. In the chart below, we can see that manufacturing in China and the USA have been closely correlated over the past several years. With the current slowdown we are seeing in manufacturing in China due to the COVID lockdown, history indicates that we will likely see a domino effect that will impact the US economy.

Source:

https://www.pantheonmacro.com/

Not surprisingly, many firms suffer during a recession,

since demand – and therefore revenue – fall, and there is increased uncertainty

about the future. But there are ways to

limit the damage.

Although there are analysts who feel we may not yet be entering a recession, the biggest difference between companies that fail and those that succeed during economic downturns is preparation. Making contingency plans or thinking through alternative scenarios is critical. Switching to survival mode, by making deep cuts and reacting defensively, can be the main difference between a company that can recover quickly and one that is not able to bounce back.

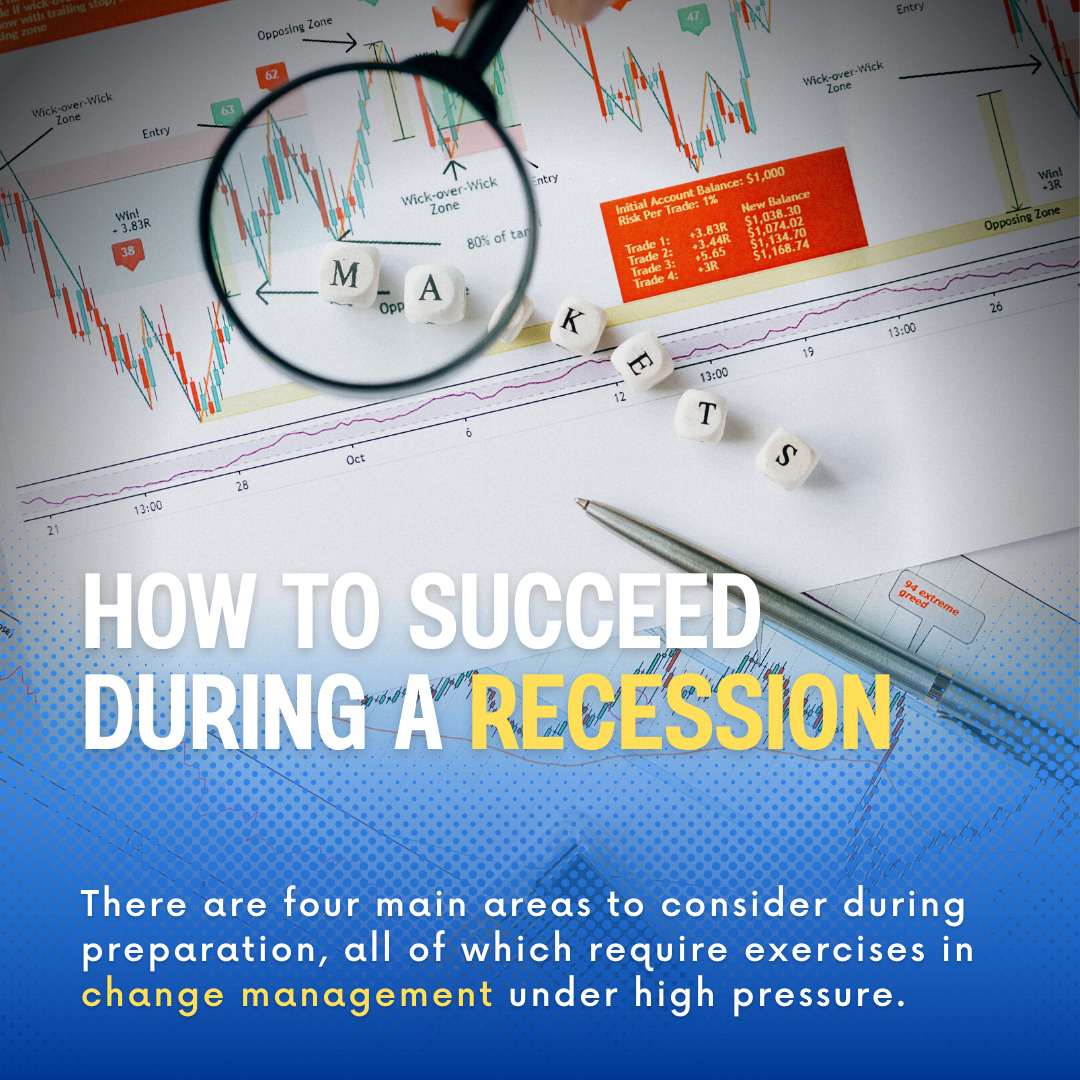

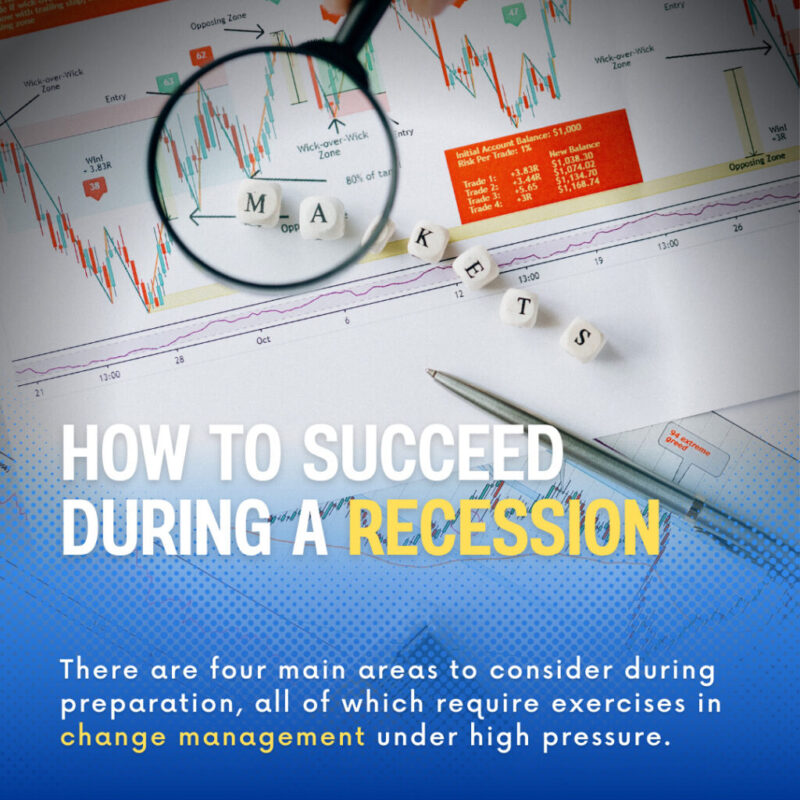

How to Prepare for a Recession

So, what do companies need to consider to be prepared? There are four main areas to consider when

preparing for a recession;

1. Debt

2. Decision Making

3. Workforce Management

4. Digital Transformation

The main message across these areas is that recessions are an exercise in change management under high pressure, and in order to be successful, a company needs to be flexible from top to bottom.

Debt

First and foremost, make sure your company tightens its belt

and doesn’t run low on cash. Since

recessions usually bring lower sales and less cash, surviving them requires

solid financial management. Companies

with high levels of debt are very vulnerable during recessions. Also, the relationship between business

closures and unemployment is closely linked to falling housing prices. The more housing prices decline, the more

consumer demand falls, which leads to more business closures and higher

unemployment. Although this certainly

impacts virtually all companies, it significantly impacts companies with weak

financial positioning. The vast majority of businesses that shut down due to

falling demand also are those that are the most highly leveraged.

The more debt a company has, the more cash it takes to make a principal and interest payment. So, when a recession comes and there is less cash available, there is an increased risk of defaulting. During a recession, the extent to which high levels of debt pose a risk depends on several factors. When companies are owned by private equity firms, they tend to fare better during recessions than those that aren’t owned by private equity firms. The reason is because private equity firms generally require companies that they finance to take on debt, and they ensure the survival of these companies by providing financial support when needed.

Decision Making

In addition to a company’s performance being based on its

decisions, it also depends on the people making those decisions. Factors

involving decisions a plan manager makes are critical to whether a company

survives. Companies in which plant

managers have little discretion over making investments, introducing new

products, making marketing decisions, and hiring employees are considered

highly centralized. Companies which do

not have highly centralized structures are associated with better performance

when facing tough environments.

Decentralized firms delegate decision making further down

the hierarchy, so they are better able to adapt to changing conditions. Decentralization matches decisions with

expertise, and the uncertainty of a recession requires that decisions need to

be made throughout the entire organization.

In short, recessions offer opportunities for great and lasting change.

Workforce Management

During a recession, some layoffs are inevitable. However, the companies that come out of an

economic trough the strongest lean more on operational improvements to cut

costs rather than laying off people.

Since hiring and training are expensive, companies prefer not to rehire

after a recession. Further, layoffs can

hurt morale, which exacerbates lower productivity at the worst time. Other options to consider are hour

reductions, furloughs, and performance pay.

One of the advantages of furloughs and short-time work is that companies

still have the discretion over which workers are affected. With performance pay, companies are more flexible

because it allows them to align workers’ incentives with the changing

conditions.

While it may be tempting to use recessions as a time to play

it safe technologically, these economic slowdowns actually appear to encourage

the adoption of new technologies. During

a recession, there is a greater demand for computer-related skills, since

companies take advantage of the high unemployment by being pickier and more

digital. Companies that increase their

investment in information technology also drive the surge in IT skill

requirements for their jobs. Furthermore,

technology makes businesses more transparent, flexible, and efficient.

Digital Transformation

During a recession, prioritizing digital transformation can

improve analytics, which will help management understand the overall business

better, how the recession is affecting it, and where there is potential for

improvements. Digital technology can

help cut costs. Automating tasks and

adopting data-driven decision making will pay off quickly. Also, IT investments allow companies to better

handle the uncertainty and change that comes with a recession, since they make

companies more agile. Digital

technologies create much more flexibility around a product, as well as around

the global supply chain.

Looking ahead, companies that have already made an

investment in digital technology and analytics may be better able to understand

future recessions and respond more quickly.

By contrast, companies that neglect digital transformation might not be able to survive the next recession.

About the Authors

Aykut Cakir has worked for major Fortune 500 companies such as Procter & Gamble, Roche Pharma Group, and John Deere. He has 28 years of experience in Operational Finance, Accounting and in General Management with international business experience including in the USA, Europe, Middle East and Turkey.

Trevor Saliba is a sought-after strategic advisor to a global client base, working with clients at every stage of the private equity, investment and M&A lifecycle. In addition, his Strategy practice advises clients on post-transaction closing matters related to post-merger and growth strategies. Previously, he also served as Chairman and CEO of NMS Capital Advisors, a subsidiary portfolio company of NMS Capital Group and a Los Angeles based boutique investment banking firm that specialized in mergers and acquisitions, cross border investment transactions, private equity and asset management advisory services to public and private clients throughout the world.