By Aykut Cakir and Dr. Harry Moore MBE

Inflation Data and Expectations

Fighting inflation is not cheap. Solutions typically require alternative supply channels and larger buffer inventory. However, holding larger inventories also means tying up valuable cash at a higher financing cost due to increased interest rates. There will also be market adjustments on shorter payment terms again due to the high interest rates. Naturally, all this combined will directly impact the cash conversion cycle and thus, the end user may have to pay more. This may seem like a vicious cycle, but by localizing the supply chain, some of these costs may be eliminated. In the case of an extended inflationary environment, expectations on the cost benefit ratios may have to be lowered.

With interest rates being historically low since the Great Financial Crisis, not many company leaders have had to deal with soaring inflation the likes of which we see today. Last year, debates took place in regard to the longevity of inflation and if it was transitory in nature. Within the first few months of 2022, economic data readings indicated that inflation rates will persist above the roughly 2% that economists predicted and central banks have positioned for. The consumer price index (CPI) rose by 8.5% year over year in March 2022 in the United States. This rapid rise in inflation was a 40-year high for the US. Similarly, CPI numbers in the eurozone, and the United Kingdom came in at 7.5% and 7% respectively.

In addition, Russia’s invasion of Ukraine has led to further recent disruptions to the energy, agriculture, and minerals markets, indicating that inflation will likely stay higher longer than anticipated, and more persistent than even revised expectations suggest.

Planning for Inflation

With the latest data in hand, central banks globally are having to raise interest rates to try to combat inflation. The severity of the issue is evident, as markets now anticipate inflation over the next five years to be 1.5% – 2% percent higher than the 2010–2019 average for the United States, the United Kingdom, and Germany.

For consultants and our clients, the looming question is what is the best way to guide teams and shareholders through a challenging period?

To begin with, although profitability is the bottom line, inflation’s impact goes far beyond just income. It is imperative to carefully evaluate the entire business cycle, as any disruptions in the cycle can have catastrophic consequences. The fresh unbiased of eye of an external person can help with the tough decisions, and management should hear out team members at all levels on their insights as well.

To help their team members get on the right path, company leaders should prepare a list of questions to review internally and take into consideration when planning for inflation. Here are a few examples that we ask clients to address right away:

1. How can you create additional value without incurring large costs?

2. How can you efficiently redesign supply chains to limit the impact of inflation and delays?

3. Should you consider repricing products in this inflationary environment?

4. How can I form a through-cycle and strategic mindset for my customer relationships?

5. Who can ensure prioritization and organization of the determined changes?

As part of supply chain analysis, consultants advise company leaders to be cognizant of the product and service design choices they make because of the lack of inventory, the volatility of commodities, and the higher production and servicing costs due to inflation. Of course, company leaders must still maintain the quality and value that customers require, leading to a delicate balancing act. Some approaches that have shown to be effective to accomplish this task include:

• Quickly redesigning products and services.

• Breaking the mold by thinking outside of the box to solve supply chain snafus.

• Being prepared to offer substitutes or implement alternative product suppliers.

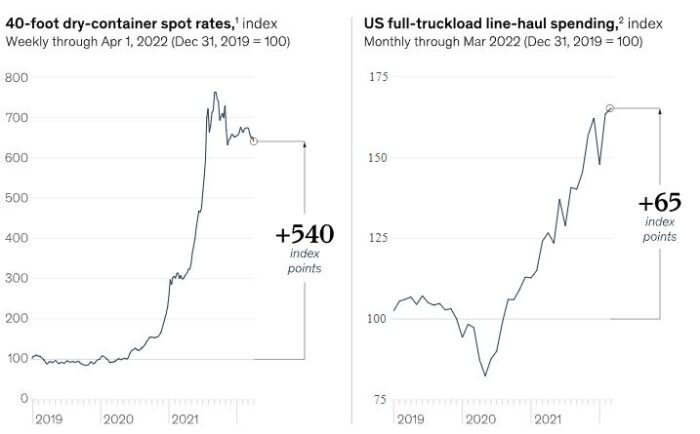

One specific key factor that was on the top of agenda lists for consultants even before Russia’s invasion of Ukraine is cost optimization. Now, with shipping costs rising significantly, as seen in the graph below, companies have been advised to increase inventory sizes, and to identify new suppliers for the raw components they need.

Supply Chain Solutions

Just a few years ago, only specialized consultants would deal with supply chain logistics and carrier issues. However, after the initial set of lockdowns due to COVID-19, and again earlier this year due to Russia’s invasion, C-suite leaders need to be aware of daily developments within their supply chain. Some key suggestions that consultants can offer to address supply chain issues include:

• Being familiar with supply chain specifics such as the location of your tier-one suppliers and key risks to disruptions.

• Being involved in the planning of supply chains from start to finish to be able to pivot quickly.

• Proactively preparing emergency plans for the possibility of any supply chain link failure to reduce down time.

• Weighing the costs and benefits of vertical integration.

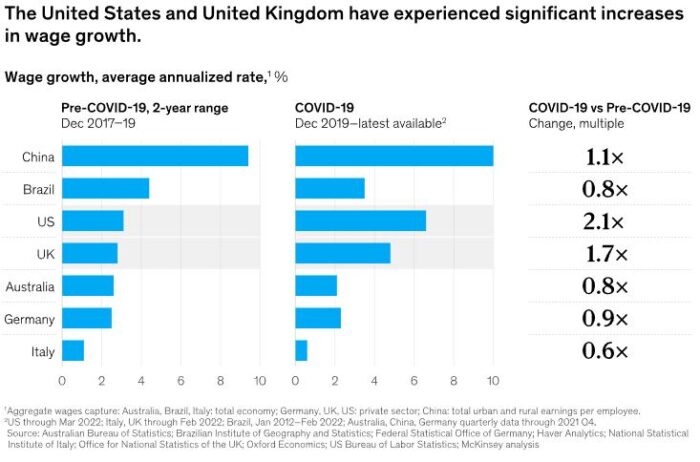

With inflation impacting everyone, it is extremely important to take into consideration employee wages and benefits. Although salaries and benefits can be a company’s biggest costs, they ensure that your company is able to recruit and hold on to top talent, while also helping your employees and their families live comfortably in a high inflation environment. Since December 2019, private-sector wages in the United States have increased at more than twice the rate of the two years before the COVID-19 pandemic, with data indicating a 6.6% annualized rate since December 2019. In the UK, wage increases reached 6.4% over the same period. As can be seen in the chart below, different labor market policies and conditions globally have led to differing wage growth around the globe.

General Inflation Strategies

In addition to considering the above, c-suite leaders must also take into consideration the following principles:

• Improving and evolving company culture as part of compensating employees

• Make monthly/quarterly reviews more about the employees needs and concerns, rather than just how they can improve.

• Reconsider hiring criteria that may be negatively impacting your ability to reach certain individuals that can make great team members.

About the Authors

Aykut Cakir has worked for major Fortune 500 companies such as Procter & Gamble, Roche Pharma Group, and John Deere. He has 28 years of experience in Operational Finance, Accounting and in General Management with international business experience including in the USA, Europe, Middle East and Turkey.

Harry Moore is the Head of Europe, Global Head of Turnaround and Transformation. His experience and expertise include international strategy, corporate turnaround, transformation, market penetration, and increasing profitability.