Continuing the Great Rebalance

By Nick Sramek and Arthur Mansourian

Eleven Years On: Seeking a Resilient Portfolio

This year we mark the eleventh year since the near-total breakdown of the global financial system. Eleven years ago, terms such as Toxic Debt and Subprime Loans were as commonplace as Snapchat and Bitcoin are today (and, perhaps, equally misunderstood). Central banks took on their name fully as “central” to the financial wellbeing of the world by coordinating actions and drastically lowering the cost of bank borrowing. Indeed, the era of “Greed is Good” drew to a close, leaving countless causalities in its wake. The headstones will not be forgotten: Bear Stearns, Fannie, Freddie, WaMu, Lehman and AIG, not to mention the trillions of global capital that vanished from personal savings, pension funds, and other retirement vehicles. Fortunes evaporated and lives were destroyed, all while a historic election was taking place in the United States that threatened to pull the country further to the extremes. As the dust settled, few were left unscathed; investors and politicians the world over began a soul-searching journey that is still ongoing.

Long-term investors (“LTIs”) in particular were shown the stark reality of their tried-and-true investment strategy: riskier than they thought and more correlated than they ever feared. This “new normal” reality required a fresh approach to asset management by LTIs – one that placed a larger emphasis on innovative management structures; a close eye on compensation; a premium on transparency; and most importantly a move away from their traditional mix of stocks and bonds. The driver had fallen asleep at the wheel, lulled into a false sense of security by how straight and level the road ahead appeared. A new approach was needed.

The resulting shift further into alternatives was paved many years ago by high-performers such as the Yale Endowment and several Canadian pension funds, showing how institutional investors can responsibly take on opportunities further up the risk curve while abiding by their fiduciary duties. LTIs began to buy up the built world and opportunities in private equity. Alternatives realized annualized rates of growth of over 10% from 2005 – 2015, doubling the growth seen in traditional sectors. (Baghai, et al) LTIs are continuing to pour money into alternatives – with real assets and private equity being the largest benefactors. Today, many funds have reached or aim to arrive at a 50%+ allocation into alternatives. Canada Pension Plan Investment Board (CPPIB), the largest pension systems in Canada, increased allocation in alternatives from 4.3% in 2005 to 47.6% in 2016. (Liu, et al) The Washington State Investment Board (WSIB) increased allocations in private markets to 48% in late-2017, one of the highest allocations to illiquid assets in the United States. (Diamond, Sept 22, 2017)

What are the forces at work pushing and pulling the market for private equity and real assets today? What will these shifts mean for investors in 2018 and beyond? How are pension funds and other long-term investors responding to additional competition for assets? How are investors differentiating themselves in the marketplace? What are some of the tailwinds and headwinds for investors going forward?

Private Equity and Real Assets: Market Drivers in 2019

Long-term investment has finally been given its rightful place at the table. Following the Global Financial Crisis (“GFC”), LTIs have become more concerned with strategic adjustments as opposed to market timing. Looking strategically has allowed for further investments as an inflation hedge, income generator, and more broadly to align with their long-term goals. One of the intangible outcomes of the GFC has been a greater appreciation for investing in the built world. For stakeholders in many of these funds, a general understanding has been that many of the effects of the GFC were due to nefarious actors on Wall Street. Through investing in bridges, water treatment plants, businesses, agriculture and timber, LTIs are categorizing finance in the minds of their stakeholders as a force for sustainable growth, and a positive force in the world.

New players from around the world are increasingly active in alternatives, emerging from underneath the thumb of restrictive regulatory regimes. These new pools of capital aim to deploy billions more in private equity and real assets, for income as well as ballast against currency fluctuations. China Investment Corporation (CIC), the $800b Chinese sovereign wealth fund, currently holds 22% in alternatives but plans on increasing allocation to 50% in the future (Liu, et al). Even Japan’s mammoth pension fund, the Government Pension Investment Fund (GPIF), is emerging into this world after decades of highly restrictive investing. In 2017, the $1.3 trillion USD fund announced that it would begin shifting assets to alternatives (McMillan). Even if they begin with a very limited exposure, this would equate to billions of new capital into the marketplace. With behemoths such as CIC and GPIF entering a market that already feels crowded, LTIs around the world have been increasingly concerned about asset pricing in alternatives. In Q3 2018, the GPIF had a rate of return of -9.06% with total assets of about $150,663,000. New approaches, requiring more information, collaboration and time, will be needed in order to extract returns seen in the past decade.

2019 Investment Trends

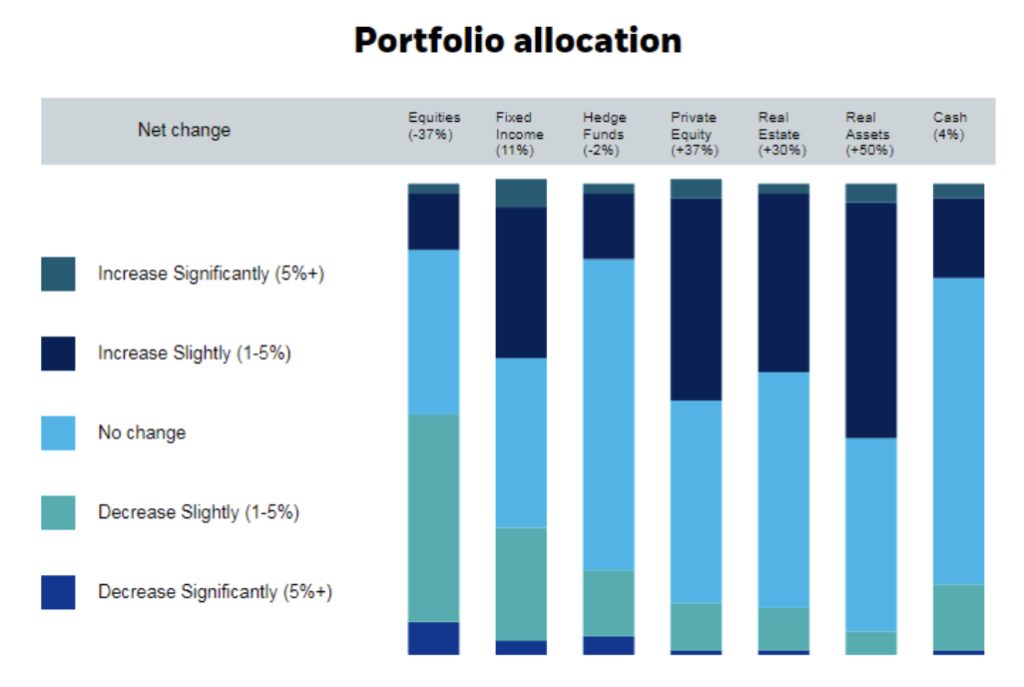

Blackrock’s annual asset rebalancing survey provides some key insights for the year ahead. The late-2018 survey assessed that an increase was seen in private markets and private credit, while a decrease was seen in equity allocations due to global economic concerns. (“2019 Global…”)

BNY Mellon’s survey found that rejection rates increased regarding trade finance transactions in a third of institutions, the central reason for trade finance rejections was identified as the constraints for compliance, more transparency is needed to develop more trade financing, and bank alignment with regulator requests is paramount. (Camp, Paul, April 2019)

Private Equity Continues to Lead the Way

According to Institutional Investor, investors plan to increase allocations to three categories – private equity (79% said they would increase allocation), infrastructure (70%), and private debt (62%). Also, 93% of private debt fund managers stated that their growth is likely to come from organic sources, and not roll-ups or acquisitions. (McElhaney, Alicia, October 19, 2018)

“Illiquids” Remain a High Priority

According to the Blackrock survey, US and Canadian funds remain tepid on equities. Overall, “illiquids” continue to be a high priority, with increased allocations to real assets, private equity and real estate, with minor decreases to liquid strategies. LTIs continued rise in comfort with illiquid strategies is clear, even as interest rates remain low and competitive forces dampen returns.

Embracing Illiquidity in Search for Yield

LTIs increasingly understand that they must do something different to obtain desired investment outcomes. “Nothing is cheap” has been the common refrain amongst institutional investors, which has led to the emergence of larger pools of patient capital. Due to market volatility and lower returns expected in traditional asset classes, LTIs are looking elsewhere for yield. They are increasingly embracing alternative income, and willing to turn to illiquid strategies to enhance returns. Many of these long-held assets, such as infrastructure, renewables, and long-lease properties provide inflation protection while generating income.

A Focus on Operational Efficiencies

The role of private equity has changed dramatically in recent decades, changing from one that was primarily driven by financial leverage and an increase in valuation multiples, to a focus on post-investment management capability and improved operations. (Liu, et al) Prequin data also shows that the majority of LTIs now favor PE strategies that focus on post-buyout activities. The focus has turned to improving the value of the assets. As investors view that “nothing is cheap,” buy-and-hold strategies are often not enough to truly unlock value.

There is a high demand on financial capital to support the real economy. By ensuring a long-term alignment of interests, companies are in a better position to invest in strategies that may be costly and painful in the short term. By increasing the time horizon, incorporating environmental, social, and governance (ESG) strategies or elsewise improving the underlying asset will become more profitable.

Leveraging Unique Time Horizons

Amid the shortage of quality assets, LTIs should leverage their unique time horizons to reach more diversified investment opportunities and identify appropriate entry/exit timing to achieve optimal returns. Seeing their time horizon as an asset to be leveraged will allow for a better fit and aligned interests. Investment cycles can be longer than market cycles, an aspect that has undervalued by LTIs in the past. With this understanding, investors are in a better position to pursue contrarian strategies and tolerate short-term market volatility. They can also fully capture emerging and future trends that may be decades in the making, such as the rise of the global middle class, opportunities in healthcare and demographic shifts, as well as emerging technologies such as artificial intelligence, robotics, agriculture technology (agtech) and financial technology (fintech).

Rise of Long Term Strategic Planning

With these changes, a parallel shift has occurred in how these organizations manage assets. The rise of long term strategic planning, creation of official investment principles, a move to in-house investing when possible, and rethinking compensation structures have allowed for LTIs to think long term and take on strategies once deemed impossible.

With this has been the rise of a defined long-term investment philosophy (referred to as investment beliefs). Defining in concrete terms an organizational philosophy will be increasingly important as LTIs further align their investments with their unique time horizons. This provides a direction for the organization and coordinates efforts between the different departments of the fund and with the board of directors. As important, these documents offer critical advice for outside partners and stakeholders in their effort to create products and strategies that best fit their goals. Many funds have done this already and publish their beliefs on their websites and in their annual reports. The investment beliefs of Ontario Teacher’s Pension Plan (OTPP), CalPERS, and the WSIB are three that highlight the strategic direction of the fund.

A Growing Distinction Between Large and Small LTIs

The GFC also provided investors with the keys to a broader managerial toolkit. Funds that have the ability are exploring co-investments, direct investment opportunities and strategic partnerships. Large LTIs are even more interested in separately managed accounts and specialized funds that meet their specific needs. On the other end of the spectrum, smaller funds value big-name general partners with a track record they can stand behind. Smaller LTIs are also continuing to employ outsourced CIOs and sign on to comingled investment vehicles.

Opportunities and Challenges Ahead

The majority of LTIs have indicated a continued interest in deploying capital in real assets and private equity in the year ahead; this strategy will be tested by several headwinds and tailwinds given the macroeconomic environment and organizational trends.

Tailwind: Articulating Investment Beliefs as a Risk Mitigation Strategy

While many of the largest funds in the world have articulated investment beliefs, an opportunity remains for funds of all sizes to create a vision for the direction of their firm. It can speak broadly to the types of investments they wish to undertake (“We will abide by an ESG code”) to specific (“ABC investment will never rise above 7%AUM”). The action itself is a terrific exercise for funds and should be created on a consensus basis to achieve maximum buy-in.

Headwind: Finding Value with Limited Resources

A continued challenge for institutional investors is finding sufficient value-for-money. While interest rates are again on the rise, the continued challenge of the “nothing is cheap” environment remains. The entrants of new, enormous pools of capital into private markets will be a challenge, especially for cash-strapped public pension funds.

Tailwind: Defining Key Performance Indicators for Compensation

Along with defining a strategic, long term plan and articulating investment beliefs, LTIs must be compensated on a long-term basis based on quantitative metrics. GIC in Singapore uses a 20-year rolling rate of return computation as a component in compensation. The shortest length of performance-based returns for any asset class there is five years. (Liu, et al) Imagine how investors will look at equities differently if they have no incentive to see the world in any shorter terms.

Headwind: Operating within Uncertainty

Despite the push for long-term thinking, eyes will never fully divert from immediate market forces. Market fluctuations in 2018 have added to concerns over short-term stability amid geopolitical tensions and shifting market sentiments. The challenge will be for LTIs to keep their eye on the prize by focusing on their investment beliefs and time horizon.

Tailwind: Reframing the Conversation on Sustainability

While sustainable investing has long been a focus of many institutional investors, a new generation of private equity funds are emerging that aim for market-rate economic returns while conforming to ESG principles. A nuanced understanding is developing that speaks to the economic argument for investing in sustainability, as opposed to having sustainability as a goal in of itself. With more market players, more information will materialize for investors to properly value these opportunities.

Headwind: Continued Pressure for Short Term Returns

While the trend is positive for most funds, politicians, board members and stakeholders often remain susceptible to short term thinking. Education will continue to play a large role to ensure that the vision for the future is clear and rash decisions are not made due to pressure from special interest groups. State pension funds are acutely sensitive to short termism. Education will remain a high priority.

Tailwind: High Level of Fragmentation

Unlike traditional asset classes, the market for alternatives is highly fragmented, providing ample opportunities for new entrants. The natural constraints on firm size in private markets are partially responsible for this fragmentation; however, this trend will continue to allow for new entrants into the marketplace that can provide creative and individualized solutions for LTIs. However, the need for yield and the slowly dwindling number of public companies in equities will spurn growth in alternative investments.

Developing Strategies for the Coming Year to Ensure Resiliency for Coming Decades

The evolution of asset allocation strategies over the past decade infers a higher level of strategic thinking and cooperation inside funds. However, systemic blockages remain that are stubborn forces in long-term alignment of interests. For many pension funds, particularly in the United States, a poor funding status and limited resources to properly hire investment professionals hinders their ability to fully dive into illiquid strategies. For these funds, simply focusing on the long term and aligning interests may never be enough – even with a high-risk strategy with a large allocation to alternatives, the low level of funding and the need for consistent payouts remain impediments to success. For some, a policy solution may be the chief method for fulfilling their promises to beneficiaries.

For may other funds in the United States and around the world, the progressive shift to real assets and private equity is a promising sign for the year ahead. Despite powerful forces that may have otherwise hindered investment into these new areas, funds are paving a path for sustained returns and resiliency in the decades to come. Of chief importance for private equity and real asset portfolios is the continued alignment of long-term objectives. The growth of strategic thinking within funds in recent years is a promising trend – investors must continue to think creatively to leverage their inherent assets, including their unique ones such as their timeframe. As rising interest rates and competition from new players continue to increase deal competition, a premium will be placed on creative thinking, cooperation and knowledge sharing.

About the Authors

Nick Sramek has a proven track record in advising clients on building and cultivating high-value, sustainable partnerships with both domestic and international organizations. He has advised international institutions, investors and non-profit organizations in understanding and communicating global macroeconomic and geopolitical trends within the Asia-Pacific region.

Arthur Mansourian has a 12-year track record as both a management consultant and investment banker, advising clients on valuation, capital markets, structured financing, mergers, acquisitions and divestitures and general corporate strategy.

Mr. Mansourian served as Vice President while at NMS Capital Advisors, when the company achieved cumulative sales growth of over 5,100% with annual compounded sales growth in excess of 120% from 2012 to 2017.

Sources:

Baghai, Pooneh; Erzan, Onur; & Kwek, Ju-Hon. “The $64 Trillion Question: Convergence in Asset Management.” McKinsey, February 2015

“CalPERS Beliefs: Our Views Guiding Us into the Future.” California Public Employees’ Retirement System website

Camp, Paul. “2019 Global Survey”. BNY Mellon. April 25, 2019.

Diamond, Randy. “CalPERS adopts new asset allocation increasing equity exposure to 50%.” Pension & Investments, December 18, 2017

“Fiscal 2018.” GPIF,

“Investment Beliefs,” Ontario Teachers’ Pension Plan website

Liu, Yue; Sun, Salley, Huang, Roy; Tang, Tjun & Wu, Xinyi. “The Rise of Long Term Investing and Alternative Assets.” The Boston Consulting Group, March 2017

Manalo, Komfie. “Large institutional investors expect alternatives to rise but challenges loom.” Opalesque, November 30, 2017

McElhaney, Alicia. “Report: Alternative Investment Industry Will Hit $14 Trillion By 2023”. Institutional Investor, October 19, 2018,

McMillan, Alex. “World’s Largest Pension Fund Starts Search for Alternative Investments.” Real Money, April 11, 2017

Moore, Rebecca. “Institutional Investors Doing Something Different to Get Returns.” Plan Sponsor, February 10, 2017

“The Unstoppable Rise of Alternatives” Willis Towers Watson Press Release, July 17, 2017

“WSIB Investment Beliefs.” Washington State Investment Board website