The Modern ESG Movement

Traditional methods of establishing a competitive advantage are not sufficient enough. It is more critical than ever that businesses address new realities, evolve with the changing conditions, and deliver effective change to gain a competitive advantage.

In recent years, Environmental, Societal, and Governance (ESG) issues have begun to make more of an impact on companies which increasingly seek to appeal to markets that often emphasize corporations which have shown dedication to these causes. Due to this, the idea that a corporation exists solely as an economic entity has become eclipsed by the conception that companies have an obligation to address ESG issues both in the public, and crucially, within their own company, in matters of procedure, impact, and industry standards.

Due to these factors, an organization must take a look at the fundamental operating procedures we consider, and ask ourselves the hard questions regarding the role and impact our current practices have on ESG issues. Notably, this means that a company will need to work to improve our understanding of the factors which can raise these issues to prominence, as we seek to rectify issues within our company. This includes actions from government entities, which are increasingly concerned with reducing carbon emissions, in addition to private entities such as loan granting institutions who wish to ensure that companies are operating with financial transparency. Another notable factor in the previous year which has expedited these concerns was the 2020 global pandemic, whose long-term economic and societal impact remains to be seen. However, it has made it clear that addressing these concerns is not a task that can be ignored.

As a result of these factors, corporations have begun to formulate a strategy for growth which formulates a cohesive unit, many of which are multifaceted strategies which can be utilized by companies at various stages of ESG development and growth. Regardless of the baseline of a corporation, many of these steps can be applied to increase their understanding and abilities to address these problems.

The Modern Agenda

To address these issues, there are three separate, but related spheres which are together able to improve a corporate structure. They are the following:

Despite the relatively independent nature of these branches, the successful integration of one into the corporate structure should support the integration and success of the others. Additionally, as personnel become more accepting of each approach to addressing ESG issues, the momentum should result in a change of corporate culture, which makes it more likely that future innovations will become more popularized within a company.

● Reimagined Reporting: This model is perhaps the most important for innovation, as non-compliance cannot be known by a company’s management if there is not set standards for how they are reported. This also includes training the employees in the new approach, and what constitutes compliance, or non-compliance with the new procedures.

● Strategic Reinvention: Ideally, the information reporting will serve as a baseline knowledge of the current culture and inclusivity regarding ESG issues. Afterwards, strategic reinvention can be used to develop both general and specific goals and methods of improving the current culture of the organization in order to become better at creating a stable environment, which is better able to develop their methods encouraging ESG inclusivity.

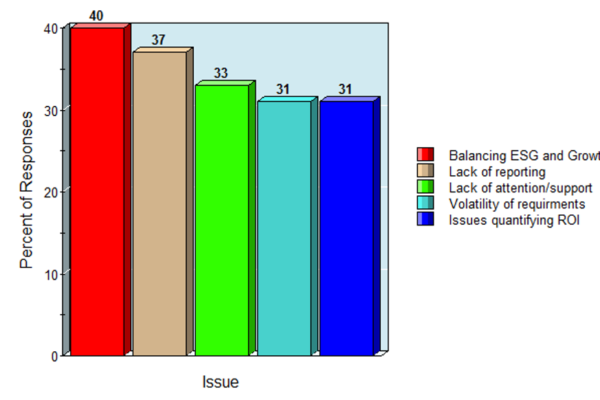

● Business Transformation: This model can be used to encourage the development or revision of business practices to be brought into compliance with initiatives that address ESG issues. Once the reporting process is undertaken, there will need to be a concise set of practical steps which are taken to correct the concerns of those affected. This will primarily take the form of developing systems to begin the process of transforming the business. This includes implementing the strategies which were developed based off of the reported infractions of agents within the company. See Exhibit B, which states the current percentage of executives who report problems with the following issues.

State of ESG Movement

ESG prioritization is rapidly becoming a point of emphasis for governments and organizations, which is a trend that is likely to continue. Both the European Union and the United States have introduced policies and initiatives regarding climate control that are only going to increase the burden on organizations and require more detailed methods of tracking progress. Due to this, it is important for organizations to begin improving their procedures in order to be better situated to function in this changing environment.

Enhancing Measurement

The methods to track ESG issues such as carbon footprints, and financial impact of environment policies are increasingly becoming complex. Due to this, it is necessary that organizations plan how to best measure and report their impact in various industries. These new methods will likely be tracked on fiscal assessment and other non-financial statements. Due to this, companies need to be able to provide specific data on both their reporting methods, and their impact.

Ecosystem Evolution, Digital Transformation

Depending on the company, the methods of innovation employed could be radically different from one another. For example, consider the role of a chemicals company, who may face unique challenges due to the high number of hazardous materials and byproducts they create, which could serve as a major hindrance to meeting government and corporate benchmarks such as attaining net-zero carbon emissions. However, the important consideration here is that by working with other companies within the supply chain who may have use of such byproducts, corporations are able to better reach their goals regarding ESG issues.

Leading the Transformation

Due to the broad nature of both the changes necessary to change the corporate structure to better address ESG issues and the potential impact of such changes, it is clear that the movement must be spearheaded by industry leaders who are willing to function at the forefront of the movement. In doing so, they are likely to provide a clear direction from within their company on the goals of such innovations. Additionally, they will be able to provide a clear model for future companies on how to implement such changes. Overall, the priority for such leaders should be to set a direction for these changes and ensure that the initiatives are properly funded, and are able to practically alter the functionalities of the company to achieve their stated goals. It is when leaders are able to become impassioned by the importance of their changes that the rest of the organization becomes motivated to support their vision and enable the necessary changes to ESG procedures and initiatives within an organization.

How NMS Consulting can Help

Change management led by experienced NMS consultants provides a uniform approach to enabling the changes mandated by a company’s initiative, mitigating risk, and drastically increasing the success rate of changes. Executives need to analyze and understand the hurdles that make transformation efforts fail, and NMS can guide the way.

Businesses are facing economic unpredictability, disruptive technology, and organizational issues. Traditional methods of establishing a competitive advantage are not sufficient enough. It is more critical than ever that businesses address new realities, evolve with the changing conditions, and deliver effective change to gain a competitive advantage. Without clearly defined milestones and sufficient commitment by management, change initiatives are bound to fail.

A focus on an organization’s people, leadership, execution, and governance is paramount to success. Change management must be executed with transparency with a focus on value for your people. To satisfy these requirements, your organization can leverage the same technologies that are triggering the transformation. The scalability and reach of digital tools provide your business with opportunities to create innovative and powerful change. We partner with you to customize the right set of solutions for your change initiatives, ensuring that the internal capabilities needed to manage change now and in the future are established.

Mr. Mansourian has a 12-year track record as both a management consultant and investment banker, advising clients on valuation, capital markets, structured financing, mergers, acquisitions and divestitures and general corporate strategy. Mr. Mansourian served as Vice President while at NMS Capital Advisors, when the company achieved cumulative sales growth of over 5,100% with annual compounded sales growth in excess of 120% from 2012 to 2017. With over $5 billion in completed transactions, the investment bank consistently ranked among the Top 10 investment banks by the Los Angeles Business Journal. Mr. Mansourian holds an MBA from USC’s Marshall School of Business and a Bachelor’s Degree from UCLA, and the CIPP/US certificate from IAPP.