M&A Frenzy will Continue, Driven by SPACs

In Q1, mergers accomplished via SPACs were valued at a record $232 billion, and represented 17% of deal activity.

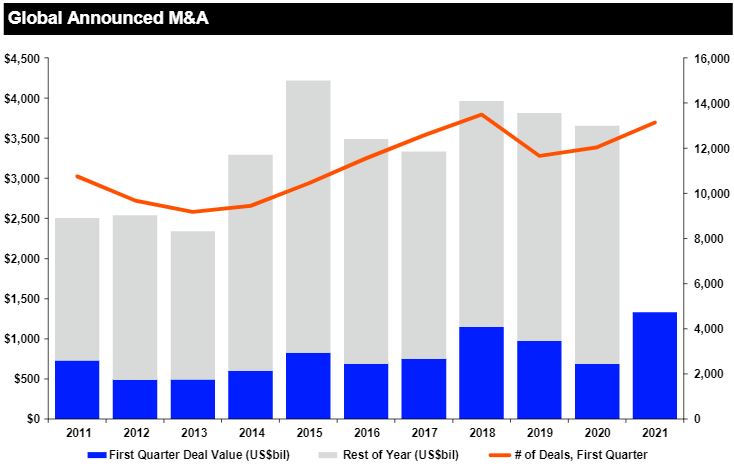

According to Refinitiv, global M&A activity reached almost $1.4 trillion in value in Q1 of 2021, representing a 94% jump year-over-year. The activity was led by technology companies and SPAC deals, with additional buoyancy from low borrowing costs and a stock market at all-time highs. With the Federal Reserve stating they do not plan on being hasty about increasing interest rates, these low costs should continue and offer a strong backdrop to M&A, including SPAC deals.

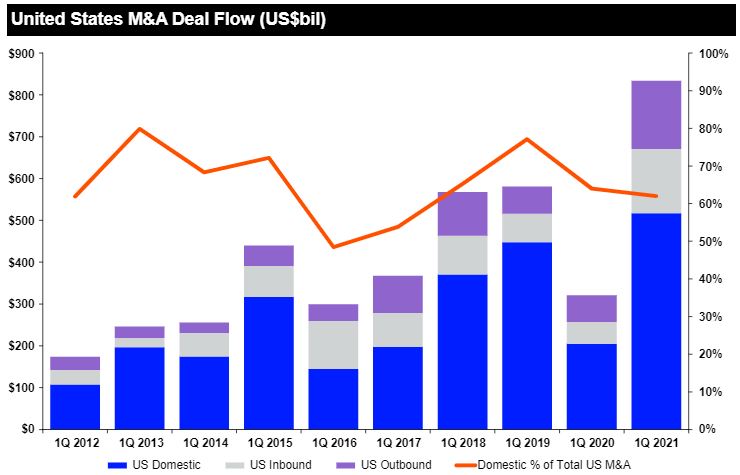

When breaking down the numbers, we see that the tech sector accounted for 21% of all Q1 2021 deals, which totaled $274 billion in value. The next largest set of deals took place in the Financial sector, which was 16% of all deals in Q1 2021. Regionally, the U.S. was the home of about half of these deals with a value of $670.5 billion, representing a 161% surge year-over-year.

As more companies look for ways to grow, cut costs, and quickly go public, SPACs have been a favored method. In Q1 of this year, mergers accomplished via SPACs were valued at a record $232 billion, and represented 17% of deal activity. In April of this year, ride hailing start-up Grab announced it will merge with a SPAC, sponsored by tech investment firm Altimeter Capital. The deal valued Grab at roughly $39.6 billion, making it the biggest SPAC deal ever.

Another catalyst that may boost M&A activity across the globe is an increase in corporate taxes, which President Biden has already put into motion. This is because companies that will be impacted heavily by an increase in taxes will look to strengthen themselves by merging with another company.

COVID-19 has also had a big impact on M&A and how it is conducted. These changes include deal terms, new due diligence issues, the availability of and pricing for other terms of deal financing, and the time it will take to close transactions. With most principal players working remotely, the use of new and collaborative techniques has become crucial. Additional due diligence issues include:

- Are the seller’s revised financial projections post-COVID reasonable?

- What is the health of the seller’s balance sheet? Does it have appropriate liquidity, enough to fund its short-term obligations?

- How have the seller’s employees been impacted by COVID-19? Does the seller have enough employees and third-party contractors to successfully continue its business, especially with the backdrop of an economy roaring back?

- Has the seller complied with laws in connection with layoffs, furloughs and new health codes?

- What is the cost to the seller of continuing to provide health care benefits to workers who have been furloughed?

- Has the seller been forced to default on contracts and/or leases?

- Who are the counterparties to the seller’s key contracts and are they performing according to those contracts?

- What are the termination rights in contracts? Do the seller’s contracts include “force majeure” clauses that may enable it or the counterparty to terminate the agreement or suspend payment?

- Have there been any negative effects of employees working from home such as data privacy and breaches? What new savings (or expenses) is the seller experiencing with employees working from home?

- What cybersecurity and data breach issues has the seller faced?

Furthermore, parties should expect longer deal timelines at each stage of the transaction, as buyers may have increased concerns about their ability to properly value a seller in this environment. Relying on valuations from comparable transactions will not be as straight forward if those transactions took place before the pandemic.

How NMS Can Help

We can help guide you and your company during the M&A process through every stage of the transaction lifecycle. We advise companies on creating value through business acquisition, combination or divestiture, including joint ventures, strategic alliances and other alternative structures. Drawing upon our team’s extensive industry and transactional expertise, we provide unbiased knowledge to help you realize your goals.

Our initial screening, qualification and analysis will reduce time and expenses normally associated with the origination process. This frees you to continue focusing on your primary business activities. Upon initiation, we provide in-depth and detailed financial, regulatory and risk assessments, which streamline the transaction process and empower you to make informed decisions. You will benefit from our knowledge and insight of a particular industry or business through strategic alliances and joint ventures as a precursor to entry.

Once a merger is consummated, we will be there to help post-integration. We will uncover the strengths of each organization and combine them in a meaningful manner, creating optimal synergies. We work to ensure a seamless process across the deal cycle resulting in a combined entity with a greater value. When it is time for an exit, we will help you identify and understand when to divest, monetize assets or how to position your firm to operate as a leaner, more efficient organization.

Source: Refinitiv

About the Author

Mr. Mansourian has a 12-year track record as both a management consultant and investment banker, advising clients on valuation, capital markets, structured financing, mergers, acquisitions and divestitures and general corporate strategy. Mr. Mansourian served as Vice President while at NMS Capital Advisors, when the company achieved cumulative sales growth of over 5,100% with annual compounded sales growth in excess of 120% from 2012 to 2017. With over $5 billion in completed transactions, the investment bank consistently ranked among the Top 10 investment banks by the Los Angeles Business Journal. Mr. Mansourian holds an MBA from USC’s Marshall School of Business and a Bachelor’s Degree from UCLA, and the CIPP/US certificate from IAPP.