IPO, Reg-A, Private Capital Services

Our IPO, Reg A+ and private capital services help you execute your mission in the offerings marketplace.

To successfully execute an initial public offering (IPO), a company will need to thoroughly plan for every aspect, including strategic communications. Choosing from the many avenues for public offerings has never been more complex, as crowdfunding offerings (Reg A+ and Reg CF) have become a viable capital markets opportunity for many organizations. When making choices, careful decision-making and planning will be required, and our IPO, Reg A+, and private capital services can help from the inception. From the preparation of the registration statement with the Securities and Exchange Commission, to the creation of marketing collateral for investor events, our experienced team will provide the solutions you need. In addition, our tools and strategies will provide your company with risk mitigation methods, more efficient timelines, and increase confidence.

How our IPO, Reg A+ and private capital services can help.

We have a comprehensive and time-tested approach to help your organization establish the right public-company infrastructure and strategic communications programs. We also work collaboratively with your team to create a customized issuance concept for a successful public offering. Our goal is to provide comprehensive consulting services that answer all your questions and provide the services you need.

Our IPO, Reg A+ and private capital services include:

- Establishing an investor relations program

- Creating a clear investment proposition

- Developing all aspects of an IPO preparation

- Educating and training your team on public company communications practices

- Creating and refining disclosure and reporting practices

- Strategic communications

- Social media advertising

- Preparation of marketing collateral

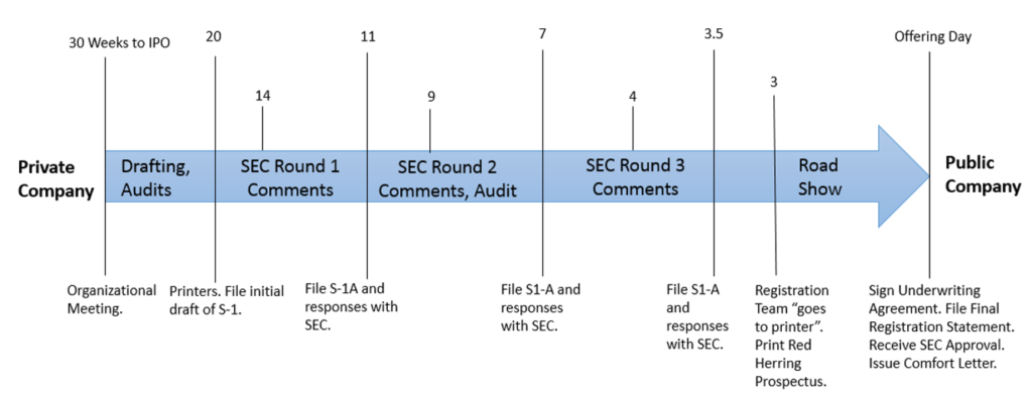

IPO Timeline

Global Coordinator

Trevor M. Saliba

Global Head of Private Equity, M&A and Strategy

Private Equity, M&A and Strategy

Beverly Hills

Arthur Mansourian

Cybersecurity & Data Privacy, Mergers & Acquisitions

Beverly Hills