By Arthur Mansourian and Harry Moore

During the COVID-19 pandemic, the item at the top of most strategic agenda was resilience. As that was being addressed, many leaders indicated a desire to take lessons away from the pandemic so that they may be used for future crises. While not as emphasized during stable periods of time, resilience does create significant value and can do so even beyond times of crisis.

Due to the immediate pressure that was put on employee performance during the pandemic crisis, transformation often needs to occur more urgently. Typically, this performance pressure can be temporarily reduced by increasing costs and asset efficiency. However, what effect does this action have for the long term? And how can companies transform for efficiency, but also resiliency?

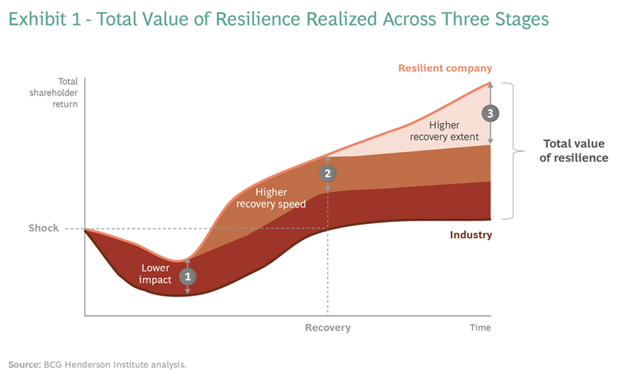

Studies have shown that about half of corporate transformations do not actually improve resilience in response to a crisis that might happen in the future. However, those same studies have also shown how some companies do successfully transform for resilience. To study those success factors as it relates to resilient transformation, the total value created by resilient companies in response to a future crisis must be quantified. There are three stages during which resilience creates value. First, the immediate impact of a resilient transformation can be lower than that on other companies because these companies better absorb the shock. Second, they can recover at higher speeds by quickly adapting to new circumstances. And finally, in the twelve-month period following a crisis, they can have a greater recovery extent, by reimagining their business to thrive in the new circumstances.

Together, the relative performance across all three stages is the total value of resilience displayed in response to a crisis, as Exhibit 1 shows.

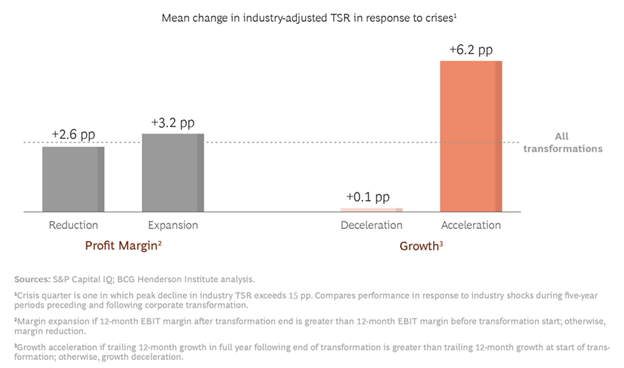

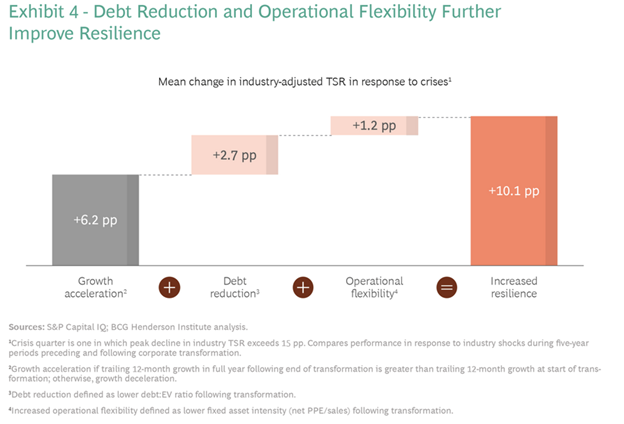

The companies that were most effective in improving resilient transformation performance showed some characteristics that can be applied to all companies. First, growth acceleration is the main driver of a resilient transformation. Second, transformations that reduce debt and increase flexibility improve resilience. And third, transformations are less likely to build resilience when a crisis is no longer fresh. Based on this information, it can be seen that resilience has benefits across the entire economic cycle.

In the past, transformations often focused on reducing costs. Although this may improve performance in the short-term, it generally does not lead to increased resilience in the event of a future crisis. However, transformations that accelerate growth improve total resilience, as can be seen in Exhibit 2.

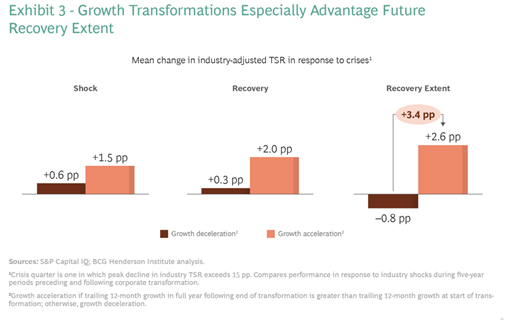

Earlier it was mentioned that in the third stage of future crises, after the recovery period has started, companies can start to reimagine their business models and products in order to succeed in the new circumstances created by the crisis. Growth-oriented transformations can create an advantage by their ability to spot and capitalize on new growth opportunities, as Exhibit 3 shows.

To lessen the negative impact of future crises, including a debt reduction in a company’s transformation is helpful. Since large-scale changes usually require a large financial commitment, company leaders may be tempted to fund change programs by increasing corporate debt, especially when interest rates are low. However, doing this drastically reduces resilience. High leveraged companies are more likely to struggle since servicing debt costs more, and it limits companies’ ability to tap into corporate debt markets in the event of a crisis in the future. Compounding the problem are investors who prefer the safety of corporations with lower debt levels.

If companies can increase operational flexibility during their transformation, they can also increase adaptivity. Companies need to adapt quickly to the changing environment and update their models. If they use the proxy of lower fixed asset intensity, they can increase that operational flexibility, and can therefore more easily adapt to perform better than expected during the recovery stage. Companies with less ownership of assets generally have a higher proportion of variable costs, which allows them to tie costs to revenue in the event of a crisis. They can also be less reliant on legacy assets, and this helps in adapting to technological advances as well as getting more market opportunities in the recovery phase.

To be sure, companies that transform by accelerating growth, reducing debt loads, and increasing operational flexibility, and do it simultaneously, greatly improve their performance relative to other companies, as Exhibit 4 shows.

While a crisis brings transformation to the forefront of a company, transforming for resilience requires changing to a new mindset. However, as things get more stable, that mindset tends to fade. When a crisis is new, corporate leaders adopt a transformation approach that also helps to build resilience. But after the crisis has passed, those same leaders generally forget how important it is to build resilience. Company efforts return to aiming to reduce costs, bond markets – which are now more stable – make debt financing more attractive, and strong operational control looks more attractive. However, regardless of the timing of the crisis, the value of resilient transformation remains the same.

The pandemic has brought the value of resilience into focus, and corporate leaders are looking to rebuild their companies to be more resilient. Even though every transformation is unique, three patterns can improve the chances for a resilient transformation. First, transform with an opportunity mindset. While it’s tempting to cut costs to produce short-term gains, transformations must increase the capacity for innovation and reinvention. Second, accelerate digital transformation. Doing so can improve resilience by increasing operational flexibility and allows the company to seize new growth opportunities. Third, keep resilience on the transformation agenda in good times as well. Future crises are inevitable, and if companies can recognize resilience as a long-term imperative, they will be in the best position to outperform the competition.

As companies get ready to reopen and grow, there is a risk of resilience fading out of importance. Companies that maintain their focus on growth, reducing debt, and increased operational flexibility will see the full value of resilience and have an advantage during future crises.

About the Authors

Arthur Mansourian has a 12-year track record as both a management consultant and investment banker, advising clients on valuation, capital markets, structured financing, mergers, acquisitions and divestitures and general corporate strategy.

Mr. Mansourian served as Vice President while at NMS Capital Advisors, when the company achieved cumulative sales growth of over 5,100% with annual compounded sales growth in excess of 120% from 2012 to 2017.

Dr. Harry Moore MBE is the Head of Europe, Global Head of Turnaround and Transformation. His experience and expertise include international strategy, corporate turnaround, transformation, market penetration, and increasing profitability. Prior experiences include leading business transformation teams at both KPMG and PwC, and being sponsored by the UK Government to manage initiatives that he designed to secure the future of enterprises in the SME sector in the UK. His strategies resulted in saving roughly 135 UK businesses.