Inflation – Where Is It?

It’s the economy, period.

Firms face economic risks. Among the most prevalent yet neglected risks is inflation. From a strategic planning perspective, firms must understand where inflation may be hiding in the economy. By identifying inflationary markets, firms can improve strategic planning processes that are centered around strategic initiatives over the foreseeable future. Inflation impacts the consumer and subsequently will lead to pricing issues for goods and services. When inflation impacts one or more markets, the consumer faces a higher cost structure, which can negatively impact price sensitive firms by reducing demand for goods and services that must compete in the market for consumer expenditures.

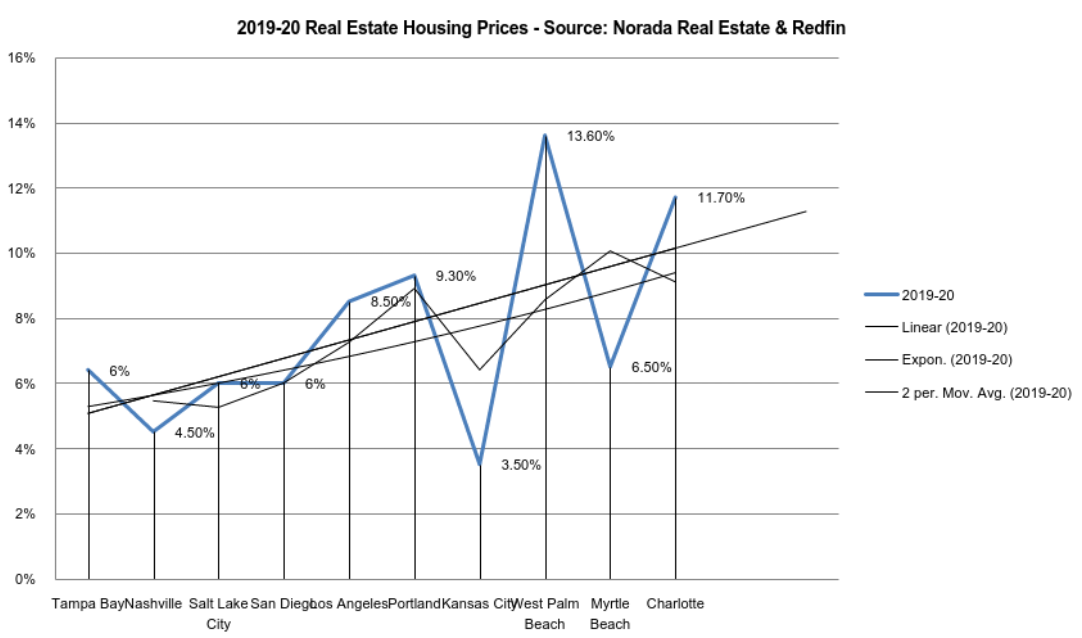

Inflation as measured by the Producer Price Index (PPI) and the Consumer Price Index (CPI) does not tell the entire story. Inflation is responsible for creating ‘bubbles’ or that which are called bubble markets. Bubbles currently exist in the housing market, particularly for housing at the higher end including luxury housing. The real estate market is subject to location, therefore, not all locations are affected. Yet, a number of locations are experiencing this type of inflation. Firms that depend on business generation from locations that are experiencing asset bubbles may be negatively impacted. The Tampa Bay region is just one location that is currently experiencing real estate inflation. Firms operating within the Tampa Bay area may not be negatively impacted now, at least not until there is a broader economic downturn that reduces demand for goods and services and thus hampers business growth by reducing revenues and profitability.

Inflation is also hiding in the stock market, notably in technology stocks and other ‘high growth’ stocks. High growth stocks do not pay dividends and so investors chase growth in the hopes that one day these companies will accumulate retained earnings and eventually payout a dividend. This activity results in a rising price/earnings ratio or a P/E multiple. Therefore, stocks that are experiencing an inflationary bubble will have a high multiple, a multiple that is at least higher than the P/E for the S&P 100. Firms should identify the inherent risks associated with bubbles in the equities market and how such bubbles can impact their investment strategy. Additionally, firms that manage or oversee employee 401ks should also understand where inflation is hiding.

What NMS Consulting Can Do For Your Firm

NMS Consulting can provide your firm with business and economic forecasts, statistical analyses as well as broader conceptual strategic planning consulting services. Our strategic planning services can provide a risk analysis and a market analysis that supplements the main industry analysis. Recommendations for your firm will reflect our expertise and strong understanding of global macro economic factors and regional economic factors that will directly influence your business operations. NMS Consulting can provide economic and financial consulting services to large corporations as well as to proprietors, SMEs, and LLPs/LLCs.

About the Author

Mr. Ramdeen has a 16 year track record with a focus on financial services, corporate advisory, and wealth management. Vidia also has public sector, healthcare, higher education, and non-profit consulting experience, providing diverse services to local, state, and federal government. Mr. Ramdeen is a Six Sigma Black Belt and has more than 10 years of experience as an independent consultant providing third party consulting services that involve LEAN consulting, varied analysis, research and recommendations.