COVID-19 and the Disruption of Global Business

COVID-19 is a black swan event that will impact businesses for months across the world.

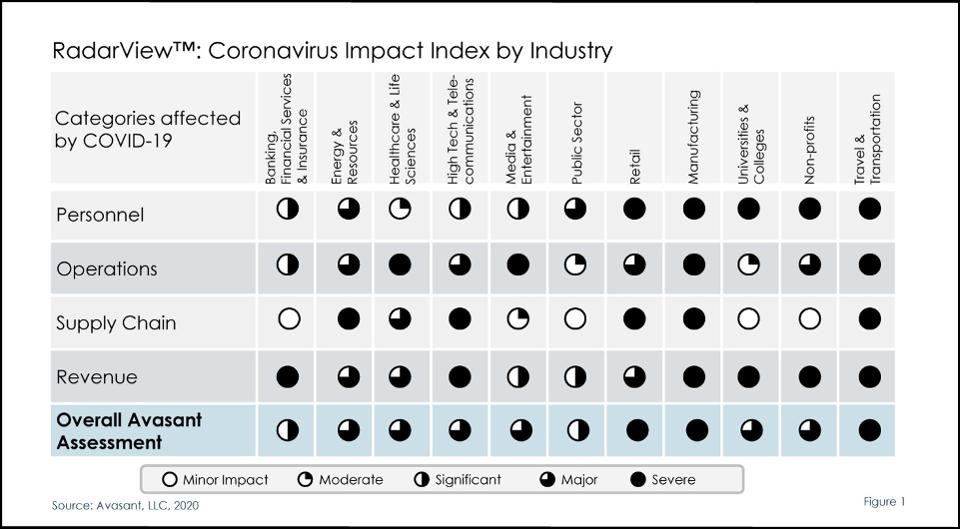

COVID-19 has served as a test of how organizations can handle disruptions in their supply chain – and the situation is not pretty. For several decades, China has been the focus on supply chain optimization, allowing for minimizing costs, increasing asset utilization, and allowing companies to reduce inventories. However, these benefits come with a hefty price when unforeseen circumstances occur – and COVID-19 has made this clear. The negative impact of having such dependency on China has removed flexibility and buffers out of the hands of employers and executives. Companies are just now realizing the vulnerability of their supply chain relationships amidst the global shock. In Wuhan, China, the epicenter of COVID-19, more than 40% of the Fortune Global 500 firms have a presence, and almost all have been extremely impacted. Apple is facing supply chain challenges. Airlines and cruise ship companies are likely going to have to be bailed out by the Federal Reserve. Tesla is reevaluating its expansion into China. Tier 1 and Tier 2 suppliers in China are facing cash flows problems. Factories are shut down and their production capacity is idle. The impact index below is an overall rating of the effect of the pandemic on each industry:

The companies which have supply chains that rely upon the Tier 1 or Tier 2 suppliers in China are facing serious challenges, and are left to aggressively innovate to combat these issues. Many analysts are predicting the COVID-19 epidemic will continue to impact businesses for many months and even years. Even after governments give their citizens the “all clear”, businesses will be cautious with spending and it will take some time for the supply chain to get back to par.

In China, all tiers work together and are bound at the hip, as the Tier 1 suppliers work with Tier 2 suppliers and the Tier 2 suppliers work with Tier 3 suppliers. This has created a frail “daisy” chain of suppliers. In addition, most Fortune 500 companies cannot even identify Tier 2 and Tier 3 suppliers – the Chinese Supply Daisy Chain provides little or no transparency nor visibility. A disruption in the chain can not only be catastrophic, but many company executives that are not physically present in the country will be left in the dark.

Companies need to digitize their supply chains to minimize the impact. The digitized supply chains support flex procurement, work with alternate suppliers outside of China and other affected areas, evaluate the risk of Tier 1, 2 and 3 Chinese suppliers, and implement a plan centered on demand, supply, risk, technology and finance. Your company’s plan needs to have a flex sourcing scheme that allows you to shift suppliers to other locations including those located in North America.

The digitalization of supply chains will enable the speed and flexibility to react to such world events in the future. Digitalization will also enable companies to predict and mitigate challenges. The introduction of artificial intelligence, machine learning and robotics process automation (RPA) to your supply chain management is vital to its effective future. It is important that current inventory levels are optimized, and “just in time” manufacturing is disbanded. This type of manufacturing works fine in an ideal environment, but is not effective when conditions are bad and in times of emergencies. A solution is a flex supply chain that allows companies to predict and adjust in times of crisis. For some companies, managing their supply chain is a tedious and time-consuming process because they have little or no digitalization within the process. A robust supply chain provides full traceability from source to destination. Companies need to know where products were produced, and where the products are at during all stages of a product in the supply chain. The supply chain traceability needs to be auditable. Digitizing your supply chain will also position your company for the ramp up after all current disruptions are eliminated.

AI models help companies streamline their most time-intensive back-office processes. These technologies, which are part of our solutions, automatically extract data from ERP systems, for AI models to forecast and create trend analyses. AI algorithms help improve material flow, fleet management, warehouse administration, logistics processes, and freight processing.

Artificial intelligence (AI) and Big Data turn large amounts of structured and unstructured data into logistics and supply chain insight, and allow companies to optimize their supply chains. The benefits are accurate time of delivery estimates, optimized vehicle routes and sequence deliveries, efficient shipment consolidation, and insight into damage claims, returns, traceability, and accountable sourcing.

Concerned employers and C-suite executives need to respond to the immediate change with force. These steps include preparing alternative solutions in the face of high absenteeism and supply chain disruptions, and focusing on cash flow to prevent any liquidity problems. It is important for companies to enhance the focus on labor planning, supplier risk, and identify alternative logistics options to avoid inventory or capacity issues. Companies need to be prepared for more drastic events such as plant closures and the possible death of a key executive. To resolve such situations, companies need to plan out all potential scenarios, and put succession plans in place.

Today is a very important time in your company’s history. The way you respond to the situation and implement solutions will reverberate for years, and can be the difference between success and failure in the face of adversary.

About the Authors

Arthur Mansourian has an 11-year track record as both a management consultant and investment banker, advising clients on valuation, capital markets, structured financing, mergers, acquisitions and divestitures and general corporate strategy. Mr. Mansourian served as Vice President while at NMS Capital Advisors, when the company achieved cumulative sales growth of over 5,100% with annual compounded sales growth in excess of 120% from 2012 to 2017. With over $5 billion in completed transactions, the investment bank consistently ranked among the Top 10 investment banks by the Los Angeles Business Journal. Mr. Mansourian holds an MBA from USC’s Marshall School of Business and a Bachelor’s Degree from UCLA, and the CIPP/US certificate from IAPP.

Oscar Perez has over 24 years of experience in developing SAP supply chain solutions, business strategies, leading complex business transformation projects, solution architecture, program project management, business case development, business process development, AI, Robotics Process Automation and solution software selection. Mr. Perez currently serves on the Board of Directors of Credit Capital and BRACHIN LLC. He has functional expertise in SAP Leonardo, Artificial Intelligence, Big Data, supply chain, SOA, SAP, CRM, RPA, procurement, corporate finance, and product marketing. Mr. Perez specializes in software selection and implementation of SAP ERP packages. Mr. Perez has appeared in publications including Computerworld, InformationWeek, and The Wall Street Journal. He is a frequent speaker at industry events and is quoted by business and trade publications.

Sources

Avasant LLC 2020 RadarViewTM

https://www2.deloitte.com/global/en/pages/risk/articles/covid-19-managing-supply-chain-risk-and-disruption.html