Sustainable Agriculture Investing

By Nick Sramek and Arthur Mansourian

Introduction

Mark Twain’s famous advice to “Buy land, they’re not making it anymore,” was ahead of its time. Even with a population of only 76 million people in the United States, Twain recognized the scarcity of land and its everlasting requirement for sustenance and advancement in a growing economy. Since the start of the 19th Century, the U.S. population has more than quadrupled and its urban concentration has increased from 40% to over 80%. (United States Census Bureau) This tremendous growth has pushed food systems to dramatically increase productivity and efficiency. Logistics companies have in turn concentrated efforts to bring agricultural products from the countryside to cities. With that, our ever-growing desire for a healthy and diverse array of foods has transformed what it has meant to be a farmer over the past 100 years. If Twain took his own advice, not only would the land he purchased almost exclusively be trucking food into urban areas, but the variety and methods of production will have been completely revolutionized many times over.

The increased demand for food has placed a greater focus on the resiliency of our food systems. Agriculture is being pushed not only to be more efficient, but increasingly to be sustainable through the support of practices that will lead to greater productivity while minimizing waste and the need for extensive inputs. Healthy soils, water, and genetic information are key inputs into our food supply chain; as resources become increasingly scarce, systems are emerging that pursue holistic development to increase crop yield while ensuring longevity. The investment case for farmland is not a new story, but is increasing due to favorable market conditions and the need for further diversification. But how should investors think about sustainable agriculture? What is the relative value of this sector and the associated risks? Where will the industry go from here?

The Move to Food: A Story of Demand

The continued growth in agriculture is a tale of global forces – demographics, globalization, urbanization, sustainability and food safety have been the chief drivers of change. The continued explosion of the middle class in economies around the world will provide ever-growing markets for nutrient-rich foods. The United Nations estimate that global population will hit 9.7 billion by 2050, up from seven billion today; population increases will go hand in hand with the hundreds of millions of people entering the middle class and moving to cities, which will place even greater pressure on food sources to be predictable and sustainable. (United Nations Department of Economic and Social Affairs) This growth in demand will require agriculture productivity to increase by 50-70 percent over current levels, right when the explosion of productivity created from the green revolution has begun to taper off. (Murray, et al) This has placed tremendous pressure to transform uncultivated land into usable space for agriculture.

Why Sustainable Agriculture Investing?

Beginning in the early 2000s, these trends created an environment for the industry to begin attracting new capital from institutional and private investors. The Global Financial Crisis can be seen as the “great awakening” of the asset class, as institutional investors collectively took a step back from their assumptions regarding diversification, liquidity, and alternatives more generally. Recent underinvestment in agriculture plus the growing demand for food in emerging markets exacerbated the need for a new era of agriculture investment. One of the most pursued macroeconomic themes of the last decade has been the push for agriculture as an investment mainstay, due to its diversification and potential for return enhancement, alongside other real asset investments such as timber, natural resources, renewable energy and infrastructure. Farmland is not only able to generate regular income but also realizes capital appreciation and can be a useful hedge against inflation. Many agriculture investments are seen as near recession-proof. Plus, it’s considered apolitical; democrats and republicans grow lettuce the same way.

Capital is expected to continue to flow into the sector as investors carve out separate allocations for tangible assets. Farmland investment as “gold with a coupon” has rung true, as investors continue to realize diversification that their shrinking bond portfolios at times didn’t, with returns far better – according to the National Council of Real Estate Investment Fiduciaries (NCREIF), over the past ten years US farmland has averaged annual returns of 16.92%. (Lang, et al) Long-term trends hold similar; historical data shows that agriculture investments have outperformed equity markets over the last forty years with lower volatility, achieving an average return of 10.7%. (Murray, et al)

Investors face stiff competition from a new cadre of institutional investors – sovereign wealth funds and pension funds, particularly from the Middle East and East Asia – are becoming increasingly comfortable deploying capital overseas into these asset classes as a means of diversification and a key hedge against currency risk (Baba). With this overcrowding, natural resources, particularly agriculture and timber, have seen new entrants. Indian AgriFood Startups raised $1.66 billion from 2013-2017, with a total of 558 deals, which represented about 10% of global deal activity (about $17 billion). (Burwood-Taylor)

Additional players and capital into the sector are a promising indicator of upward trends in demand and valuations for the asset class. The diverse array of funds focusing on agriculture today represents a new era for agriculture; investors large and small have the ability to pool funds for greater impact in the space and inject technology and new management practices into agriculture systems.

Sustainable Agriculture:

Moving from the Green Revolution to the Organic Green Revolution

The Green Revolution of the 1950s-1970s refers to a series of technological innovations that reshaped human history, alleviating extreme famine and bringing millions out of poverty, particularly in Latin America and Asia. Norman Borlaug, the perceived father of the Green Revolution, led initiatives into the spread of high-yielding cereals, chemical fertilizers, pesticides, and genetically altered seeds. While the revolution may have gotten its footing in Mexico, it shined in India. The dissemination of IR8, a genetically modified rice, was particularly successful with yields ten times greater than conventional varieties. The Green Revolution helped avoid monumental famine in India; Borlaug would go on to win the Nobel Peace Prize in 1970 and credited with saving over a billion people from starvation. (Easterbrook) While opponents argue that the Green Revolution ushered in a new era of genetic uniformity in crops, clear-cutting of forests, and far-reaching health consequences that remain unknown, his impact on the poorest in emerging economies can’t be discounted.

However, the yield growth created by the Green Revolution is generally acknowledged to have plateaued. (Lang, et al) The continued increase in the need for food through demographic and economic trends is placing increasing pressure to transform uncultivated land into land suitable for agriculture. Forests in particular have become vulnerable to this trend – agriculture development is the largest contributor to deforestation. (Lang, et al) Monoculture crops and cattle ranches have exploded in response to demand for staple crops and protein sources. These actions have created a whole new set of sustainability-related risks, including soil erosion, biodiversity, and climate change. Clearly, a new model is needed to suit the 21st Century needs of a changing planet.

Sustainability agriculture investing proponents have called the recent explosion of technological tools and management techniques the birth of the Organic Green Revolution, which aims to meet the modern agriculture needs while mitigating climate change risk, prevent further soil erosion, and restore clean water sources. Regenerative farming practices aim to integrate agricultural systems with biological process which, in normal circumstances, can lead to greater yields, improve drought and flood resistance, and increase soil regeneration. Organic farming today accounts for only 1% of total agricultural land, representing an untapped resource for improved efficiency and sustainability to feed the estimated ten billion people living on earth in 2050. Skepticism remains, but a growing body of evidence suggests that organic farming practices, when done correctly, can meet the food demands of the world. (Reganold)

How Can we Define Sustainable Agriculture Investing?

The Royal Society has put forward a helpful definition of what constitutes sustainable food systems. In their definition, sustainable agriculture: minimizes the use of external inputs into the food system; promotes soil regeneration through nutrient cycling and biological nitrogen fixation; minimizes usage of technological practices that have negative impacts on the environment and humans; fully utilizes human capital (management techniques) to resolve problems of scale; quantifies and minimizes greenhouse gas emissions; and promotes clean water and biodiversity conservation. (Royal Society, 2009) It is important to note that this definition allows for flexibility in the use of genetically modified organisms (GMO) and greenhouse gas (GHG) emissions. While there are ardent believers in zero-GMO strategies and strict GHG guidelines, this definition provides a practical framework for consumers and investors to follow that allows for broad adaptation in markets around the world.

Sustainable Agriculture: What is the Investment Case?

The demand for sustainable and organic food is growing rapidly both in markets within the U.S. and around the world. (USDA) Apart from similar mechanisms that have made investments into traditional agriculture a success (demographic and economic growth combined with resource scarcity), sustainable agriculture has several key value drivers. Across companies, investors can find value due to premium pricing, lower input costs, consistency of yield, and potential risk mitigation through drop diversification. (Murray, et al)

Sustainable agriculture investors can thus view opportunities in the sector to improve efficiencies within companies or seek returns due to favorable market conditions. If they see investments as the former, upfront costs would be necessary and time-intensive. Pursuing organic practices, revitalizing water systems or soil composition is a multi-year effort requiring illiquidity tolerance and investors willing to let the process run its course before seeking returns. Investors may alternatively look at sustainable agriculture investing given the economics of organic and natural foods. Younger generations in particular are willing to pay a premium for sustainable food. (“We Are What We Eat”) Purchasing companies that already have significant sustainability efforts is an effective method for generating stable returns.

According to a recent survey by the Global Impact Investing Network (GIIN), sustainable food and agriculture showed the largest growth of any sector, despite the relatively low level of investment (seven percent). (Held) As the interest and demand for sustainable food systems and agriculture practices grows, opportunities for long term investors will also increase. While data is scarce, returns for sustainable agriculture seems to be on par with conventional farmland performance, with investors targeting an internal rate of return of 9-15%. (Held)

Where are the Opportunities?

Given the variety of mechanisms from which to improve farmland practices using technology, leveraging efficiencies and installing new management practices, there are numerous points of entry for investors seeking growth, yield, or diversification. Indeed, sustainable agriculture can find a home in almost any asset class, from private debt in farms or cooperatives, to public equities, to private equity and venture capital.

Generally speaking, sustainable agriculture investments can be grouped into three strategies:

- Developing Ecosystems

Through the implementation of sustainable agriculture practices, efficiencies can primarily be realized through the development of agriculture ecosystems that ensure regenerative growth of the asset. Enhancements in biodiversity, water quality, and soil health can increase the long-term productivity of the asset and increase its resale value. Ecosystem development also considers the holistic management of crops by providing regenerative practices. For example, creating a rotational ecosystem of agriculture and livestock practices has the ability to provide diversification within the asset to overcome (or take advantage of) price and climate fluctuations. Overall, developing a regenerative ecosystem can be a multi-year effort requiring considerable expertise and an illiquidity commitment.

- Improving Scalability

Improvements in the physical infrastructure of farmland can increase both the scalability and market options. This can include improvements in irrigation systems, building storage facilities and providing further vertical integration up and down the supply chain of the assets (purchasing refrigerated trucks or packaging companies). Improvements in scalability can be viewed as the traditional method to realize improvements in traditional agriculture practices. The concern for sustainable practices is the potential for conflicting goals of pursuing greater efficiencies through scaling up and pursuing organic, regenerative practices. Sustainable agriculture investors must ensure that long-term alignment remains central if they chose to pursue a strategy of building out the physical infrastructure and improving scale.

- Improving Management Efficiencies

Reorienting and educating the farmland management team can have a profound impact on the sustainable practices of an asset. Similarly, with private equity investments, new investors may install a “change agent” that has experience in converting a farmland asset to organic or regenerative practices. Finding the right individual who can oversee physical improvements to the asset as well as oversee changes in the ecosystem is key to success, but often the most difficult aspect.

Injecting Technology

Several promising AgTech companies have been founded recently as well, utilizing big data, artificial intelligence and drones to maximize the efficiency of farmland. Often the increased efficiencies that these technologies can achieve pay for the cost to farmers in a short span of time, making it an attractive proposition for farmers at a small or large scale. While other industries have utilized next-generation tools to maximize outputs while increasing efficiencies, agriculture has largely been undercapitalized. Capital into AgTech represents clear returns; the increased efficiencies are easily tracked but often simply lack funding to make possible. Institutional investors, with long time horizons and deep pockets can provide funding for operators to fully utilize these tools. New technologies can provide added value to any of the strategies.

What are the Risks and Impediments?

Sustainable agriculture investing is not without several risks. While the distribution is lower than most asset classes and provide diversified, risk-adjusted returns, several constraints exist that have limited the growth in sustainable agriculture investing.

- Unpredictable Climate Patterns

Climate change – plus regional and local factors – will always create a level of unpredictability in the asset class. Drought, heavy rains, early frosts, soil erosion, and other external factors will continue to challenge land managers and investors to adjust expectations and focus on the long term. Regenerative and organic farming has the ability to overcome particular effects of global warming and environmental degradation through ecosystem development and management of crop rotation, but this risk will continue to be present.

- Access to Capital

Apart from exogenous climate risks, the chief culprit preventing further development of the sustainable agriculture industry is access to high-quality, long term capital. Without managers with a demonstrated track record of success, communicating specific strategies can prove difficult. First funds face skeptical investors who already look at the young sustainable farmland industry with a wary eye. This is changing, however; as the industry emerges, more data points will be able to provide a clearer risk/return profile. Sophisticated models will emerge for best-in-class implementation strategies. Most importantly, managers must clearly articulate (and provide quantitative evidence) of the financial, environmental, and social returns that sustainable agriculture practices are capable of achieving. Again, sentiments about environmental, social and governance factors are changing rapidly as more and more investors are tying sustainability into their investment beliefs framework. As this trend continues to emerge (especially in the US, which holds billions in untapped institutional capital), investors will take into account not only the short-term returns and diversification offered by sustainable agriculture, but also the long-term alignment of interests.

- Lack of Data

Data was mentioned previously but it’s worth repeating; farmland investors have found it difficult to provide a clear connection between the implementation of sustainable farmland practices and financial performance. Similarly, with valuing infrastructure projects, performance indicators are difficult to come by at the sector level due to the uniqueness of each asset. No two farmland assets are the same – assigning an expected return based on historical data is difficult and requires access to a broad set of farmland investments. Again – with the development of the industry will come further data to rely on. Moreover, there is a need for an objective third party that can aggregate and anonymize sustainable farmland performance indicators. This is being done in infrastructure investments through non-profits such as the European-based Long-Term Infrastructure Investors Association (LTIIA) and will be a growing need in sustainable agriculture.

- Scarcity of Experienced Land Managers

As mentioned previously, there is a scarcity in experienced land manager change agents who understand the complex implementation strategies needed for sustainable land management. Managers must understand local conditions as well as the sustainable practices available. Most importantly, the manager must have a true alignment of incentives and goals with the farmland investor. If a qualified land manager is unavailable, the farmland investor must rely on current management’s ability to learn and install a new sustainability regime or oversee land improvements. Without the proper training and oversight, this could lead to poor implementation.

- Regulatory Hurdles

While policy support for traditional agriculture practices has been well documented, sustainable practices receive relatively little assistance. Government subsidies may deter investment in sustainable agriculture practices even with increasing demand and pricing. Government programs have long existed to reduce risk for farmers by providing price guarantees to offset annual yield fluctuations. With increased interest in sustainable food products and practices, lobbying efforts will generally increase. Until then, the math for switching to sustainable practices for farmers is hamstrung by subsidies for commodity crops.

- Prohibitively High Land Prices

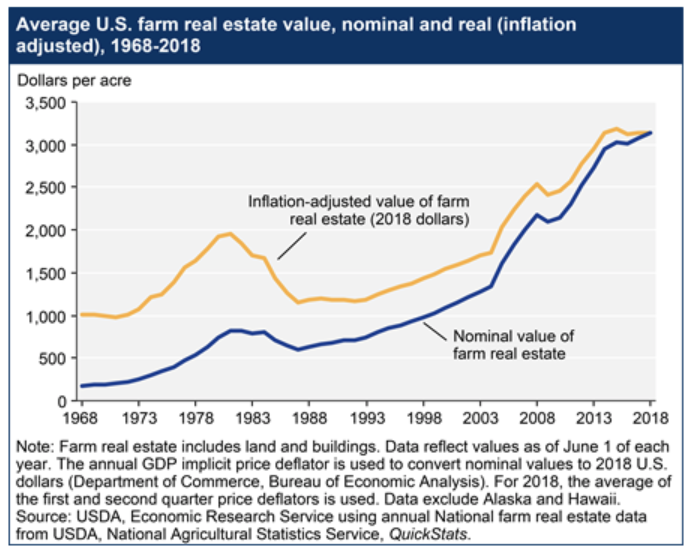

The continued rise in land prices has also made it difficult for investors and farmers to deploy capital in sustainable agriculture. With interest rates on a recent slide, farmland prices are likely to continue to increase as mortgage rates have dropped, to 4.06%, the largest weekly decline in 10 years. Interest rate hikes in 2017 and 2018 were not enough to cause a significant dip in farmland prices and investors at times struggle to find attractive assets, especially if costly and lengthy changes are needed to switch to regenerative agriculture. High land prices have also prevented farmers from investing in sustainable practices at the expense of short-term productivity. For further investment to occur, investors will need farmland prices to reflect both a short- and long-term value proposition. Average farm real estate values continue to increase, even though sector-level farm income has declined. (Bigelow)

What Should Investors Keep in Mind?

Investing in sustainable agriculture involves a thorough understanding of how the sector fits within the asset management approach of the investor as well as its alignment within the investment beliefs.

Portfolio Questions

Several investment-related questions should be kept in mind when considering a sustainable agriculture strategy.

- Where will the sector sit in your investment portfolio?

- Do you have an understanding of the liquidity constraints of the investment and related penalties?

- Can you diversify within the investment (e.g. row versus permanent crops)?

- Do you have a long-term plan for the strategy?

- What are the costs of transiting to a new strategy? Are you able to pay the upfront costs and providing enough time for the sustainability practice to play out?

Investment Belief Questions

Pension funds, endowments and other long-term investors are increasingly putting down a series of investment beliefs that drive the entire portfolio. These can be seen as the fund’s core values and drive decisions big and small. Investment beliefs can include how the fund treats its employees, views on risk and liquidity, focus on long term outcomes, favored governance models, as well as their stance on environmental and social stewardship. Investors should ensure that their investment beliefs are aligned with both the sustainability components of the farmland investment as well the financial performance.

- Are there any inherent conflicts between the asset and the investment beliefs?

- Is the investment holistic? (sustainable and focused on the long term)

- Are you creating capacity for farmers, or locking them in to long-term contracts?

- Are you adding to the corporatization of farmland, or creating a new model?

Where does the Sector go from here?

The story of sustainable agriculture is one of long-term demand drivers, cultural shifts, and technological change. As investors continue to seek returns further afield from traditional asset classes, the sector will appeal to a growing swath including more state and local pension funds, sovereign wealth funds and endowments. A transition is already underway; sustainable farmland investors are an increasingly sophisticated group of investors that spend the time needed to understand the asset class and hire personnel specialized in farmland, timber and other real assets. Low interest rates will continue to push investors out of their comfort zone to seek returns. The sustainable agriculture investment universe will continue to expand as market and policy shifts address the challenges listed above. As of March 28, 2019, the U.S. 10 Year Treasury yield is 2.391%, and fears of a global recession lead many to believe that rates will go even lower. (Domm)

One of the chief changes to occur in the sector will be the entry of data collection and monitoring practices to cement the connection between sustainable activities and financial performance. Nonprofits and academic institutions should take a leading role with this service to provide investors with objective analysis. With this, analysis should also be conducted to compare and understand the relative value of sustainable farmland investing compared to traditional practices. Further research is needed to dissect sustainable agriculture practices more fully in order to understand the chief value drivers for both environmental and financial impact. TIAA, one of the global leaders in sustainable farmland investment, is already gaining insights; improved irrigation systems and water management has led to better risk management, lower costs, and increased regional competitiveness of their farmland. (TIAA)

The United Nations Principles for Responsible Investment (UNPRI) is a global leader in reporting, data collection and analysis of sustainable farmland investments. TIAA, AP2 (Second Swedish National Pension Fund), APG Asset Management, and the Environmental Agency Pension Fund among others have contributed to efforts of the UNPRI by reporting and making their efforts in the sector publicly available. The UNPRI have outlined a set of implementation measures for sustainable farmland to allow investors to begin institutionalizing their sustainable practices in a standard framework. As more institutional investors sign on to these efforts, findings will become more robust and useful to all; asset owners will have a deeper data set from which to assess sustainable practices, and manages will be able to gain an understanding of the investment beliefs and farmland strategies of institutional investors.

When examining sustainable agriculture, regions that are still developing within the Asia-Pacific are expected to provide the fastest growth driven by countries like China and India. Government agendas for sustainable farming in these areas will play a key role in maintaining steady growth in the market. Globally, the increasingly larger environmental concerns provide the path for growth of bio-based organic fertilizers. In North America, the growth of retail sales is predicted to be about 10%-20% per year until 2023. In Europe, the biological organic fertilizers market is the most advanced and widespread among all the other regions. The infrastructure and distribution network of organic fertilizers is well-established in many European countries. Demand for organic food continues to increase, which is leading to more utilization of biological fertilizers, along with organic manures. France, Germany and Spain have reduced the overall agricultural chemical usage by more than 30% in recent years. (Parker)

As the sector continues to grow, institutional investors will develop strategies for localized investments into sustainable food management systems. For local governments and investment leaders within cities, promoting resilient communities and economic development will continue to be a key strategy; sustainable agriculture practices that increase efficiency, improve access to healthy foods, and relieve logistics bottlenecks will add value to cities confronted with population growth and thus increasing pressure on their food systems. Models will emerge partnering institutional investors, farmland managers and local governments to realize food security goals and environmental stewardship for the public and risk mitigation and financial returns for investors. The Public-Private Partnership (PPP) model utilized extensively for infrastructure projects in the US and around the world may be a good use case model for local governments to turn to for increasing the resiliency of their food systems.

While these mechanisms are developed, investors will need to be proactive and creative to find partners willing to take on unconventional strategies and invest in assets that are difficult to value. Aligning long term interests with sustainable farmland funds and like-minded institutional investors through joint venture agreements will be key for continued success in the sector. As development continues, barriers to entry will drop and further incentivizing investment.

Sustainable Agriculture: Gold with a Coupon, but Resilient

Agriculture investing’s moniker as “gold with a coupon” is well-deserved; like gold, traditional farmland benefits from being a hard asset, diversified from stocks and bonds, and a terrific inflation hedge. Additionally, demographic and economic forces will only increase demand for food commodities throughout developed and emerging markets. However, can this extend into the future? Modern farming practices alongside natural phenomena have led to thirty percent of the world’s arable land becoming unproductive in the past forty years. Erosion is increasing ten times faster in the US than the replenishment rate; China and India are losing soil at thirty and forty times the replenishment rate, respectively. (Lang) Clearly, this “gold” is flaking away and investors in farmland need to be aware of the long-term resiliency of their assets.

Risks still abound when investing in farmland more generally, as well – not mentioned in this article are the considerable market forces at work; skeptics believe that a land-price bubble is on the horizon. Others argue that growing demand – and decrease in supply through erosion and soil nutrient depletion – mean that the investment thesis for farmland is on solid footing.

Sustainable farmland in particular requires not only short-term faith in market conditions but also an appreciation of the long-term value that sustainability brings. While the mainstreaming of sustainable agriculture is occurring, time and dedication to the sector is still needed. Today, investors require highly proficient teams, a willingness to try new models, and a commitment to long-term drivers. These investors partner with like-minded players to reduce risk and share resources. As the sector continues to develop, the barriers to entry (particularly the upfront costs needed to value this unique asset class) will drop.

Much is needed to further build the resiliency of sustainable agriculture investing – solutions are required from policymakers, academics, investors, and farmers in order to achieve the vast growth potential of the sector. Despite these challenges, however, optimism remains high. Economically, evidence is showing that sustainable agriculture can provide market-rate returns; culturally, a shift in thinking about how and what we eat are demand drivers for decades to come; and technologically, sustainable solutions to agriculture’s biggest hurdles are becoming cheaper and more prevalent. As long as investors are willing to invest the time and resources, opportunities will continue to grow in sustainable agriculture.

Sources

Baba, Razak Musah. “Agriculture and Timber 2018 Outlook: Organic Growth” IP&E Real Assets. December 22, 2017.

Bigelow, Daniel. “Farmland Value” USDA. September 6, 2018.

Burwood-Taylor, Louisa. “EXCLUSIVE: Indian AgriFood Startups Raise $1.7bn in Venture Capital 2013 – 2017” AgFunder News. March 28, 2019.

Easterbrook, Gregg. “Forgotten Benefactor of Humanity” The Atlantic. January, 1997.

Farris, John R. “Here’s Why US Farmland Returns are Consistently High” Business Insider. March 24, 2015.

Held, List Elaine. “Impact Investors Flock to Sustainable Agriculture” Green Biz. October 24, 2017.

Lane, Ben. “Hello refis? Mortgage rates just had the largest one-week drop in 10 years” HousingWire. March 28, 2019.

Lang, Humphreys & Rodinciuc. “Impact Investing in Sustainable Food and Agriculture Across Asset Classes” Trillium Asset Management Publication. May 2017.

Lang, Susan S. “’Slow, insidious’ Soil Erosion Threatens Human Health and Welfare as well as the Environment, Cornell Study Asserts” Cornell Chronicle. March 20, 2006.

LaSalle, Hepperly, and Diop. “The Organic Green Revolution” Publication, The Rodale Institute. 2008.

McMahon, Paul. “The Investment Case for Ecological Farming.” White Paper, SLM partners. January 2016

Murray, Lucyann & McGrath, Meaghan. “Sustainable Farmland Investment Strategies” Independent Study, Yale School of Management & Yale School of Forestry and Environmental Studies. November 2016.

“Organic Market Overview” United States Department of Agriculture, Economic Research Service.

Parker, William. “Market Dynamics: Biological Organic Fertilizers Market Complete Market Analysis by Growth Opportunities, Demand, Production, (Forecast 2018-2023)”. The News Mates. March 28, 2019.

“Population Distribution Over Time.” Website, United States Census Bureau.

“Reaping the Benefits: Science and the Sustainable Intensification of Global Agriculture.” The Royal Society. October 2009. “Responsible Investment in Farmland” Publication, TIAA Asset Management. 2014.

“Responsible Investment in Farmland: Report 2014-2015” Publication, UNPRI. 2015.

Reganold, John. “Can we Feed 10 Billion People on Organic Farming Alone?” The Guardian. August 14, 2016.

Rollins, Adrian. “Why Australian Agriculture Can’t Draw Investment” In The Black. December 1, 2017.

Sullivan, Paul. “On the Farm, Investors Get Their Hands Dirty” The New York Times. October 27, 2017.

Domm, Patti. “The bond market has been spooked and so the big interest rate slide is likely not over” CNBC, March 28, 2019.

Thompson, Amy. “Foreign Investors Are Snapping Up US Farms” MotherJones. August 4, 2017.

“We Are What We Eat: Healthy Eating Trends Around the World.” White Paper, Nielsen. January 2015.

“The World Population Prospects: 2015 Revision.” Website, United Nations Department of Economic and Social Affairs.